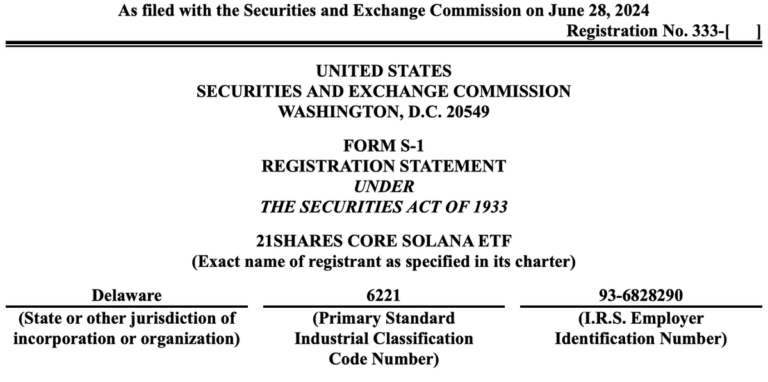

The rapidly evolving landscape of cryptocurrency investments has taken another significant leap forward with the recent filing for the 21Shares Core Solana ETF. This landmark filing with the U.S. Securities and Exchange Commission (SEC) not only underscores the growing importance of Solana within the crypto ecosystem but also signals a broader acceptance and integration of digital assets within traditional financial markets.

The intersection of traditional finance and digital assets has been increasingly populated with innovative financial instruments designed to bridge these two worlds. The filing of the 21Shares Core Solana ETF represents a pivotal moment in this journey, offering investors a novel opportunity to gain exposure to Solana, a blockchain renowned for its high performance and low transaction costs.

Understanding the 21Shares Core Solana ETF

At its core, the 21Shares Core Solana ETF aims to provide investors with a straightforward and regulated means of gaining exposure to Solana (SOL), one of the most promising blockchain networks. This ETF, once approved, will trade on major exchanges just like any other stock, enabling investors to include Solana in their portfolios without directly purchasing or managing the digital currency.

What is an ETF?

An Exchange-Traded Fund (ETF) is a type of investment fund that is traded on stock exchanges, much like stocks. ETFs hold assets such as stocks, commodities, or bonds and generally operate with an arbitrage mechanism designed to keep trading close to its net asset value. The 21Shares Core Solana ETF is designed to track the performance of Solana, providing investors with the potential to benefit from the blockchain’s growth and innovation without the complexities of managing individual crypto assets.

Why Solana?

Solana has emerged as a leading blockchain platform due to its high throughput and low transaction costs. It has quickly become a favorite among developers and investors for building decentralized applications (dApps) and other blockchain-based projects. Its innovative approach, combining proof-of-history (PoH) with proof-of-stake (PoS) consensus mechanisms, has enabled it to process thousands of transactions per second, far surpassing many of its competitors.

Key Benefits of the 21Shares Core Solana ETF

The introduction of the 21Shares Core Solana ETF brings numerous benefits to investors and the broader market:

- Accessibility: Investors can gain exposure to Solana without needing to understand the complexities of blockchain technology or managing digital wallets.

- Regulation: As a regulated financial product, the ETF offers a level of security and oversight not typically associated with direct cryptocurrency investments.

- Diversification: Including the Solana ETF in a portfolio allows for diversification into the burgeoning crypto market while mitigating some risks associated with direct ownership of digital assets.

The Significance of SEC Approval

The filing with the SEC is a crucial step in bringing the 21Shares Core Solana ETF to market. SEC approval would signal a strong endorsement of the ETF’s structure and its compliance with regulatory standards, potentially paving the way for other similar products. This move could accelerate the mainstream adoption of cryptocurrencies and blockchain technology by making them more accessible to a broader range of investors.

Market Implications

The approval of the 21Shares Core Solana ETF could have far-reaching implications for the cryptocurrency market. It could drive significant inflows of capital into Solana, boosting its market value and encouraging further development on the platform. Moreover, it may set a precedent for other cryptocurrency ETFs, fostering a more robust and diversified market for digital assets.

Investor Considerations

For potential investors, the 21Shares Core Solana ETF represents a compelling opportunity but also comes with certain considerations