The cryptocurrency market has experienced a significant slowdown as trading volume on major exchanges declined by more than 50% within a 24-hour period. This sudden decrease in trading activity reflects a temporary shift in market dynamics and highlights the importance for investors to closely monitor market trends. In this article, we will explore the factors contributing to this decline and its implications for the crypto market.

The Decrease in Trading Volume

The decrease in trading volume indicates a reduced level of buying and selling activity among crypto traders. There are several factors that might have contributed to this decline. Firstly, market consolidation has played a role, as traders may be holding onto their assets during uncertain times. Secondly, regulatory uncertainties surrounding cryptocurrencies have created a sense of caution among investors. Lastly, some traders might have decided to take profits from their investments, leading to a decrease in overall trading activity.

Impact on Major Cryptocurrencies

The recent decrease in trading volume can be observed across various cryptocurrencies. Bitcoin (BTC), the leading digital asset, witnessed a minor loss in the last 24 hours, with its trading price hovering around $25,765. Ether (ETH), the second-largest cryptocurrency, also recorded a loss and is currently trading at $1,729. Other altcoins such as Tether, Binance Coin, Dogecoin, and Solana were also affected by the decline in the overall crypto market.

Market Valuation and Performance

The decline in trading volume has had a notable impact on the market valuation of the entire crypto sector. It decreased to reach $1.05 trillion, reflecting the overall decrease in investor sentiment. While some cryptocurrencies like Ripple, Cardano, Tron, and Polygon managed to gain small profits during this period, the majority experienced losses.

Regulatory Challenges and Liquidity Issues

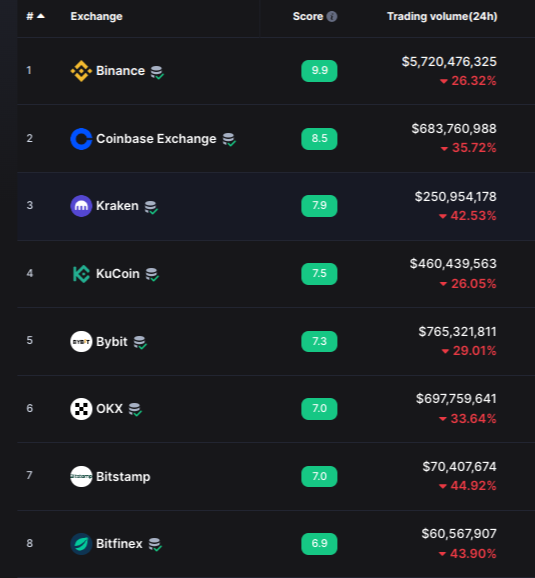

Regulatory challenges and liquidity issues have played a significant role in impacting the crypto market. Ongoing lawsuits against major exchanges like Binance and Coinbase, brought forth by regulatory bodies such as the US Securities and Exchange Commission (SEC), have created uncertainty among investors. This regulatory scrutiny has led to cautiousness in trading activities and prompted some investors to withdraw their funds.

Understanding Volatility and Opportunities

Despite the market slowdown, it’s important to note that the cryptocurrency market remains highly volatile and subject to sudden fluctuations. While some investors might choose to adopt a wait-and-see approach during this period, others view it as an opportunity to enter or exit positions strategically. It is crucial for investors to exercise caution and conduct thorough research before making any investment decisions. Cryptocurrency investments come with inherent market risks, and it is recommended to seek professional financial advice when considering investments in this volatile market.