Last Updated on June 25, 2023 by COINBUZZFEED

Bitcoin has emerged as a popular investment option, captivating the attention of investors worldwide. However, the volatile nature of the cryptocurrency market often leaves investors grappling with the challenge of timing their investments perfectly. To tackle this issue, a strategy called Dollar Cost Averaging (DCA) has gained prominence.

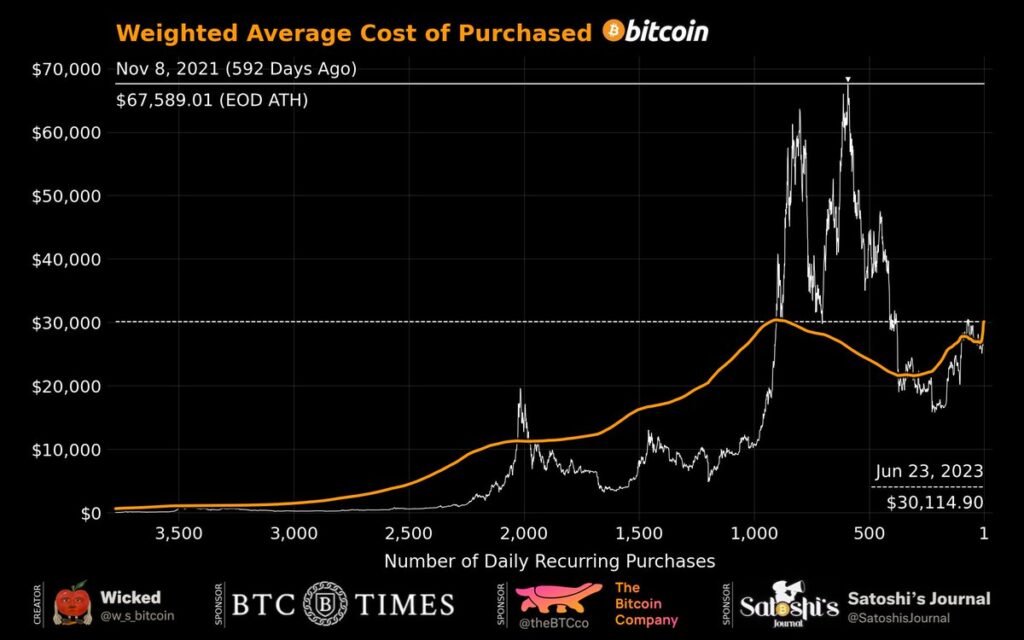

Dollar Cost Averaging is a simple yet effective investment technique that allows individuals to invest a fixed amount of money at regular intervals, regardless of the asset’s price. Instead of attempting to time the market by investing a lump sum at once, DCA involves spreading investments over time. For instance, one could choose to invest $5 per day or $100 every other week. By doing so, investors can mitigate the risks associated with market volatility and potentially reap significant rewards in the long run.

Reduced Risk

One of the key advantages of Dollar Cost Averaging is its ability to help mitigate the risks associated with market volatility. Fluctuations in the price of Bitcoin are a common occurrence, and attempting to time the market perfectly can be an incredibly challenging task even for seasoned investors. DCA provides a solution to this problem by allowing investors to spread their investments over time. By consistently investing a fixed amount, investors reduce their exposure to short-term price fluctuations. This strategy facilitates a more consistent and steady accumulation of Bitcoin over the long term.

Consider this scenario: If an investor were to invest a lump sum in Bitcoin at a specific point in time, they would be heavily influenced by the price at that precise moment. If the price subsequently drops, their investment would suffer in the short term. However, with Dollar Cost Averaging, the risk is mitigated as investments are spread over time. This approach allows investors to benefit from the average price of Bitcoin over an extended period, smoothing out short-term market fluctuations.

Avoiding Timing Mistakes

Attempting to predict and time the market accurately is a daunting task. Even experienced investors often struggle with making accurate predictions about price movements. Timing mistakes can have a significant impact on investment outcomes, potentially resulting in missed opportunities or substantial losses.

Dollar Cost Averaging helps investors overcome the challenge of market timing. With this strategy, investors commit to investing a fixed amount at regular intervals, regardless of whether the price of Bitcoin is high or low. By removing the need to make accurate market predictions, DCA eliminates the pressure associated with timing decisions. Instead, investors can focus on consistently accumulating Bitcoin over time, benefitting from both price dips and surges in the long run.

The power of Dollar Cost Averaging lies in its ability to provide a disciplined approach to Bitcoin investment. By investing a fixed amount at regular intervals, investors develop a habit of consistent investment, regardless of short-term market movements. This approach instills a sense of discipline and removes the emotional element often associated with investing, leading to better long-term results.