Solana vs Ethereum: A Comprehensive Comparison

When it comes to choosing between Solana vs Ethereum, here’s a quick snapshot:

Ethereum:

– Launched: 2015

– Market Cap: $250+ Billion

– Strengths: Established dApp ecosystem, robust security, leading DeFi and NFT platform

– Weaknesses: High gas fees, slower transaction speeds

Solana:

– Launched: 2017

– Market Cap: $35+ Billion

– Strengths: Fast transactions, low fees, environmentally friendly

– Weaknesses: Criticized for centralization, network stability concerns

In this detailed guide, we’ll explore these two blockchain giants in depth.

Why Compare Solana and Ethereum?

Ethereum, introduced in 2015, revolutionized the blockchain space with its smart contracts and decentralized applications (dApps). It’s a powerhouse in DeFi and NFTs with a sprawling ecosystem.

Solana, on the other hand, has quickly risen since its 2017 launch. Known for its speed and efficiency, Solana’s unique Proof of History consensus has caught the attention of many developers and users seeking low-cost, fast transactions.

I’m John Creek, an expert at CoinBuzzFeed. With years of experience analyzing blockchain technologies, I’ll guide you through everything you need to know about Solana vs Ethereum.

Let’s dive in.

What is Ethereum?

Ethereum is a blockchain platform that launched in July 2015. It was created by Vitalik Buterin, a programmer who saw the potential to expand blockchain’s capabilities beyond just a payment system like Bitcoin.

Vitalik Buterin and the Birth of Ethereum

Vitalik Buterin, co-founder of Bitcoin Magazine, proposed Ethereum in 2013. He wanted a more flexible blockchain that could support decentralized applications (dApps) and complex smart contracts. With the help of developers like Gavin Wood and Joseph Lubin, Ethereum raised over $18 million in a 2014 token pre-sale, setting the stage for its future success.

Smart Contracts and Decentralized Applications

Ethereum introduced smart contracts, which are self-executing contracts with the terms directly written into code. These contracts automatically fulfill conditions without needing third-party verification. This innovation opened the door for decentralized applications (dApps), which are applications that run on a decentralized network instead of a single server.

Market Capitalization and Ethereum 2.0

Ethereum is the second-largest cryptocurrency by market capitalization, after Bitcoin. As of December 2023, its market cap was around $250 billion. The platform has a significant presence in the DeFi and NFT sectors, making it a cornerstone of the blockchain ecosystem.

Ethereum 2.0 (also known as Eth2 or Serenity) is a major upgrade aimed at improving scalability, security, and sustainability. This upgrade includes a shift from the energy-intensive Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS). PoS is more energy-efficient and allows for better scalability by enabling more transactions per second.

Proof of Stake

In a PoS system, validators are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. This method is less energy-intensive compared to PoW and is expected to make Ethereum more secure and scalable.

Ethereum’s transition to PoS was completed on September 15, 2022, a milestone known as “The Merge.” This transition has made Ethereum more efficient and capable of handling a higher volume of transactions.

Ethereum continues to evolve, with a robust developer community and a clear roadmap for future improvements. Its established ecosystem and ongoing advancements make it a strong player in the blockchain space.

Next, we’ll dive into Solana and explore how it compares to Ethereum.

What is Solana?

Solana is a blockchain platform launched in March 2020. It was created by Anatoly Yakovenko, a former Qualcomm engineer, with a vision to solve the scalability issues faced by earlier blockchains like Ethereum.

Proof of History

One of Solana’s standout features is its Proof of History (PoH) consensus mechanism. Unlike traditional consensus methods, PoH uses timestamps to verify transactions. This innovative approach records events in a specific sequence, making the network more efficient.

Transaction Speeds and Low Fees

Solana is known for its lightning-fast transaction speeds. The network can process over 65,000 transactions per second (TPS), making it one of the fastest blockchains available. This speed is a significant advantage over Ethereum, which processes around 15 TPS.

Another key benefit is Solana’s low transaction fees. High gas fees have been a major issue for Ethereum users, especially during network congestion. Solana addresses this problem by offering much lower fees, making it more accessible for everyday transactions.

Market Capitalization

As of the latest data, Solana has a market capitalization of over $35 billion. This places it among the top cryptocurrencies, although it still trails behind Ethereum’s market cap of over $250 billion.

Solana’s rapid growth and innovative technology have attracted a lot of attention from developers and investors alike. Its unique features, such as PoH and high transaction speeds, make it a formidable competitor to Ethereum.

Next, we’ll dive into the key differences between Solana and Ethereum.

Solana vs Ethereum: Key Differences

When comparing Solana vs Ethereum, several key differences stand out, particularly in their consensus mechanisms, transaction speeds, gas fees, network congestion, programming languages, smart contract capabilities, and use cases for their native tokens.

Consensus Mechanisms: PoS vs. PoH

Ethereum 2.0 uses a Proof of Stake (PoS) consensus mechanism. Validators are selected based on the number of ETH they hold and are willing to “stake” as collateral. This method is more energy-efficient than the previous Proof of Work (PoW) model and improves network security.

Solana, on the other hand, employs a unique combination of Proof of History (PoH) and Proof of Stake (PoS). PoH timestamps transactions to create a historical record, allowing validators to agree on the order of transactions more efficiently. This innovative approach boosts both speed and security.

Throughput and Transaction Speeds

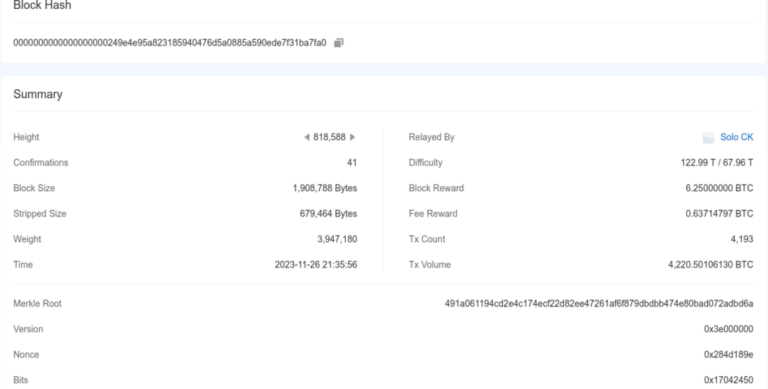

Ethereum currently handles about 15-30 transactions per second (TPS). However, with the implementation of Ethereum 2.0 and future scaling solutions like danksharding, this number is expected to rise significantly.

Solana is designed for high throughput and can process up to 65,000 TPS, making it one of the fastest blockchains available. This high speed is crucial for applications requiring rapid transaction times.

Gas Fees and Network Congestion

Ethereum is notorious for its high gas fees, which can vary widely based on network congestion. During peak times, gas fees can soar, making transactions expensive.

Solana boasts significantly lower transaction costs, around 0.0001 SOL per transaction. Its architecture is designed to minimize computational power, resulting in reduced fees and making it more attractive for high-frequency transactions.

Programming Languages and Smart Contract Capabilities

Ethereum uses Solidity as its primary programming language for smart contracts. Solidity is influenced by languages like C++, Python, and JavaScript, making it relatively easy for developers with experience in these languages to learn.

Solana uses Rust for its smart contracts, supported by its Sealevel platform. Rust is known for its memory safety and performance, offering parallel processing capabilities that significantly increase throughput. Rust’s growing popularity and supportive community make it a compelling choice for blockchain development.

Use Cases for Native Tokens (SOL vs. ETH)

Ethereum’s ETH is used to pay for transaction fees, computational services, and staking in the PoS consensus mechanism. Beyond its utility, ETH is also a store of value and an investment asset, fueling a wide range of applications from DeFi to NFTs.

Solana’s SOL serves multiple purposes, including paying for transaction fees and staking to secure the network. Like ETH, SOL is also an investment asset and a store of value. The efficiency and scalability of Solana’s network make SOL integral for developers and users engaging with the platform’s dApps and services.

In the next section, we’ll explore the ecosystems and development of both platforms, diving into their dApp ecosystems, DeFi protocols, NFT marketplaces, and more.

Ecosystems and Development

Overview of dApps, DeFi, and NFTs on Both Platforms

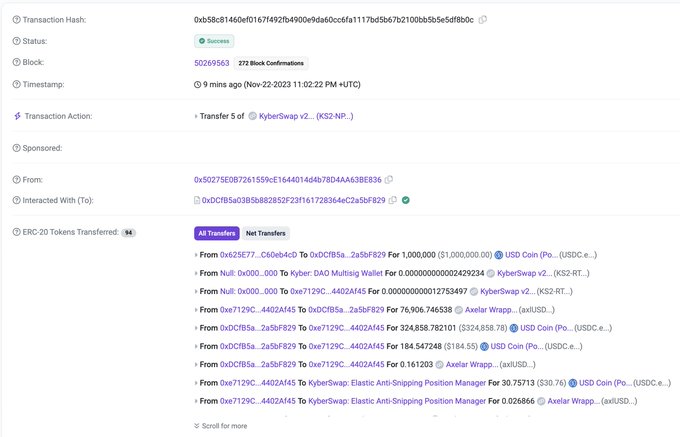

Ethereum is the pioneer in decentralized applications (dApps). With over 4,500 dApps and 584,000 unique active wallets (UAWs), it has the largest and most diverse ecosystem. Ethereum is the birthplace of DeFi (Decentralized Finance), hosting major platforms like Uniswap, MakerDAO, and Compound. These platforms have revolutionized borrowing, lending, and trading in the crypto space.

In the NFT (Non-Fungible Token) field, Ethereum leads with platforms like OpenSea dominating the market. The security and compatibility of Ethereum’s EVM (Ethereum Virtual Machine) make it a preferred choice for developers.

Solana, though newer, has quickly built a strong dApp ecosystem with over 350 dApps and 1.28 million UAWs. Solana focuses on high throughput and low transaction costs, making it attractive for DeFi projects like Jupiter, Raydium, and Orca. These platforms leverage Solana’s speed for a smoother user experience.

In the NFT space, Solana is making significant strides with marketplaces like Solanart and Metaplex, offering a cost-effective alternative to Ethereum’s higher gas fees. Solana’s mainstream integrations, such as the Solana Saga smartphone and partnerships with the Helium network, further improve its ecosystem.

Prominent dApps and Projects

Ethereum hosts some of the most significant projects in the crypto space. Uniswap, a leading decentralized exchange (DEX), allows users to swap tokens directly from their wallets. MakerDAO and Compound offer decentralized lending and borrowing services, with billions of dollars locked in their contracts. In the NFT space, projects like CryptoPunks and Art Blocks have set records in digital art sales.

Solana boasts innovative projects like Jupiter, a DEX known for its speed and low transaction costs. Raydium and Orca are other notable DeFi platforms on Solana, providing liquidity and trading services. Audius, a decentralized music streaming service, and Star Atlas, an immersive online game, highlight Solana’s versatility. Solana is also home to trending memecoins like Bonk (BONK) and dogwifhat (WIF), showcasing its capacity for viral, meme-based projects.

TVL Comparison

The Total Value Locked (TVL) metric measures the amount of assets staked, lent, or pooled in DeFi protocols. According to DefiLlama, Ethereum leads with a significantly higher TVL compared to Solana. This reflects the maturity and trust in Ethereum’s ecosystem.

Ethereum’s TVL is driven by its extensive DeFi protocols, with platforms like Uniswap, MakerDAO, and Compound holding substantial value. The network’s stability and security contribute to its high TVL.

Solana’s TVL, while lower, is growing rapidly. DeFi platforms like Raydium, Orca, and Jupiter contribute to its TVL, benefiting from Solana’s high throughput and low fees. However, Solana has faced challenges with network stability, which can impact its TVL.

Developer Community and Support

Ethereum has a robust developer community, supported by years of development and a wide range of educational resources. Ethereum’s community is known for its active participation in hackathons and its extensive documentation. This support system has fostered innovation and collaboration, making Ethereum a go-to platform for developers.

Solana also has a vibrant developer community, attracting those interested in high-performance applications. Solana hosts hackathons and offers educational resources to support developers. Despite being newer, Solana’s community is rapidly growing, driven by its innovative projects and integrations.

In the next section, we’ll dig into the security and decentralization aspects of both platforms, examining their network security, past issues, and levels of decentralization.

Security and Decentralization

Security and Past Network Issues

Ethereum has a long history, which has helped it address many security concerns. One major event was the DAO hack in 2016, where an attacker exploited a vulnerability, stealing 3.6 million Ether (worth around $50 million then). This led to a controversial hard fork, resulting in Ethereum (ETH) and Ethereum Classic (ETC). Since then, Ethereum has strengthened its security measures, especially with the transition to Proof of Stake (PoS) in Ethereum 2.0, making 51% attacks more costly and difficult.

Solana, despite being newer, has faced its own challenges. The network has experienced several denial-of-service (DoS) attacks, causing outages. For example, during an Initial DEX Offering (IDO), bot activity overwhelmed the network with 400,000 transactions per second, causing a crash. Solana has since implemented the QUIC protocol for faster communication and the Firedancer validator client to improve stability and security by providing an alternative if one client encounters issues.

Comparison of Decentralization Levels

Ethereum is highly decentralized, with a vast number of nodes contributing to its network security. Anyone with the necessary hardware and software can participate as a validator, which distributes network control widely. The shift to PoS has further lowered the barrier to entry, encouraging more participation.

Solana aims for decentralization but faces challenges due to its high transaction throughput, which demands significant computational power from validators. This can lead to potential centralization, as running a high-performance node can be costly. However, Solana is working to increase its number of validators to improve security and censorship resistance. The introduction of the Firedancer validator client is a step towards improving network reliability and decentralization.

In the next section, we’ll explore the investment perspectives of Solana and Ethereum, comparing their market performance and price predictions.

Investment Perspective

Market Performance: ETH vs. SOL

When it comes to market performance, Ethereum (ETH) and Solana (SOL) have both shown impressive gains, but their paths have been quite different.

Ethereum has long been a cornerstone of the cryptocurrency market. It’s the second-largest crypto by market capitalization, right after Bitcoin. Ethereum’s price has been volatile but has shown resilience, especially with the rise of DeFi and NFTs. The transition to Ethereum 2.0 and the shift to Proof of Stake (PoS) are expected to address some of its scalability and transaction cost issues, potentially leading to increased adoption and value appreciation.

Solana, on the other hand, has been a rising star. Since its launch, Solana has seen rapid price increases, driven by its high throughput, low transaction costs, and growing ecosystem of dApps. In 2023 alone, Solana’s price jumped by over 554%, largely due to its vibrant ecosystem, particularly in the DeFi and memecoin sectors. However, Solana has faced challenges, including network outages, which have raised concerns about its stability and scalability under stress.

According to TradingView, since the 2023 Bull Run began, SOL has outperformed ETH by a wide margin, returning well over 450% in the past year, compared to ETH’s 50%. Despite these gains, Ethereum still boasts a much larger market cap, with $360 billion compared to Solana’s $60 billion.

Price Predictions

Ethereum’s future price is closely tied to the successful implementation of Ethereum 2.0. This upgrade could significantly improve its appeal as a platform for dApps, driving up demand for ETH. Analysts foresee Ethereum maintaining its position as a leading blockchain for DeFi and NFTs, supporting a long-term upward trend in its price.

Solana’s price outlook will depend on its ability to maintain high throughput and low costs while addressing stability issues. If Solana can overcome these challenges and continue attracting new projects and users, it could see continued appreciation in value. However, investors should be mindful of the risks associated with network outages and their impact on investor confidence.

Investment Opportunities

From an investment perspective, both ETH and SOL present intriguing opportunities. Ethereum’s established dApp ecosystem and the anticipation surrounding Ethereum 2.0 suggest a promising future. Its extensive network effects and years of development offer a robust foundation for continued growth.

Solana, while still developing, offers a compelling case for cutting-edge dApps and innovative projects looking to leverage fast transactions and scalability. Its recent price performance has been impressive, but the network’s stability remains a key concern.

Market Capitalization and Future Outlook

Ethereum remains a strong contender due to its large market cap and established ecosystem. The upcoming Ethereum 2.0 upgrade is set to transform the network, improving scalability, security, and energy efficiency. This upgrade is highly anticipated and expected to address some of the critical issues currently facing Ethereum, potentially driving future growth and adoption.

Solana, with its innovative technology and active ecosystem, has captured the attention of investors looking for the next big opportunity in the blockchain space. However, its future outlook contains both promise and potential problems. The network’s ability to handle increased demand without compromising stability will be crucial for its long-term success.

In the next section, we’ll address some frequently asked questions about Solana vs Ethereum to help you make informed investment decisions.

Frequently Asked Questions about Solana vs Ethereum

Is Solana a better investment than Ethereum?

Solana and Ethereum have distinct advantages and challenges, making them suitable for different types of investors.

Transaction Costs: Solana is known for its low transaction fees, often less than $0.01 per transaction. In contrast, Ethereum’s gas fees can be significantly higher, especially during times of network congestion.

Scalability: Solana boasts high scalability with the ability to handle thousands of transactions per second (TPS). Ethereum, while improving with Ethereum 2.0, still lags behind in terms of TPS.

Market Dynamics: Ethereum has a more established market presence and a larger developer community. This stability can be appealing to long-term investors. Solana, on the other hand, is gaining traction rapidly but is considered more speculative.

Will Solana ever overtake Ethereum?

The possibility of Solana overtaking Ethereum depends on several factors:

Market Lead: Ethereum has a significant head start with a market capitalization of over $250 billion. Solana, while growing, is currently valued at around $35 billion.

Bull Run and Growth Potential: Solana has shown explosive growth, especially during market bull runs. For instance, between November 2023 and April 2024, Solana’s network activity surged, with daily transactions surpassing 25 million compared to Ethereum’s 1.14 million.

Future Outlook: Ethereum’s transition to Proof of Stake (Ethereum 2.0) and its robust ecosystem of dApps and DeFi projects make it a formidable platform. Solana’s rapid growth and technological advancements give it potential, but it remains to be seen if it can sustain this momentum and overcome its current limitations.

What are the negatives of Solana?

Despite its advantages, Solana has several drawbacks:

Centralization: Critics argue that Solana is more centralized compared to Ethereum. The high cost of setting up a node limits the number of validators, with Solana having around 3,000 validators versus Ethereum’s 800,000+.

Validator Concerns: The relatively low number of validators raises concerns about network control and security, making it more vulnerable to potential attacks.

Network Stability: Solana has faced multiple network outages, including a notable 20-hour downtime in February 2023. These outages highlight potential stability issues that need to be addressed for long-term reliability.

Understanding these factors can help investors make more informed decisions when choosing between Solana and Ethereum.

Conclusion

As we wrap up our comparison of Solana vs Ethereum, it’s clear that both platforms offer unique strengths and face distinct challenges.

Ethereum stands out with its established ecosystem, robust developer community, and proven track record. Its transition to Ethereum 2.0 has improved scalability and transaction speeds, making it a reliable choice for long-term investors and developers. Ethereum’s extensive dApp ecosystem and dominance in DeFi and NFTs provide a strong foundation for future growth.

Solana, on the other hand, boasts impressive transaction speeds and low fees thanks to its innovative Proof of History mechanism. This makes it an attractive option for projects needing high throughput and low costs. However, Solana’s network stability and centralization concerns are critical factors to consider.

Key Takeaways

- Ethereum: Established, secure, and evolving with Ethereum 2.0. Ideal for developers and investors looking for stability and a proven platform.

- Solana: Fast, low-cost, and growing rapidly. Suitable for projects requiring high transaction speeds but comes with stability and centralization concerns.

CoinBuzzFeed

At CoinBuzzFeed, we aim to keep you informed about the latest developments in the blockchain world. Whether you’re a developer, investor, or blockchain enthusiast, understanding the nuances between platforms like Solana and Ethereum is crucial for making informed decisions.

For more insights and updates on Solana, visit our Solana Community page.

Informed Decisions

In the changing crypto landscape, staying informed is key. Both Solana and Ethereum have their merits and potential drawbacks. Your choice will depend on your specific needs, whether it’s speed, cost, stability, or community support. Keep an eye on both platforms as they continue to develop and adapt to the market’s demands.

Stay curious, stay informed, and let your knowledge guide your journey in blockchain.

By understanding the strengths and weaknesses of both Solana and Ethereum, you can make better decisions that align with your goals. Keep exploring, and don’t hesitate to dive deeper into the fascinating world of blockchain technology.