The Solana-based memecoin BEER saw an 80% drop in value shortly after the launch of its perpetual contract on Bybit. According to on-chain analyst Wazz, this significant price decline has raised alarms about potential market manipulation by insiders.

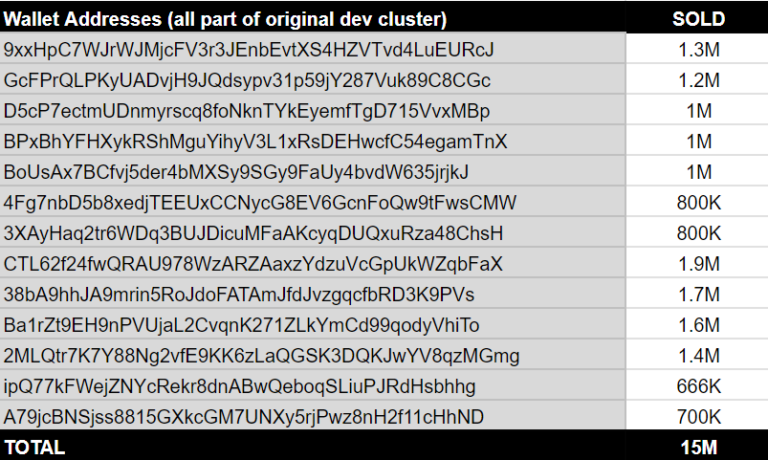

Wazz’s analysis suggests that insiders and team members might have cashed out more than $15 million during the price collapse. There are also concerns that these insiders could control more than 50% of BEER’s total supply. This level of control raises the possibility that they are using Bybit’s perpetual contracts to manipulate the market price of the memecoin.

Market Manipulation Concerns

Market manipulation occurs when individuals or groups engage in practices that artificially influence the price of a security or asset. In the case of BEER, the manipulation allegedly involved dumping large amounts of the coin to trigger a sharp price decline. This activity can create panic among other investors, leading to further sell-offs and exacerbating the price drop.

The use of perpetual contracts on Bybit might have played a crucial role in this scenario. Perpetual contracts are a type of futures contract with no expiration date, allowing traders to speculate on the price of an asset with leverage. This leverage can amplify both gains and losses, making it a powerful tool for those looking to influence market prices.

Implications for the Memecoin Market

The allegations surrounding BEER underscore the risks inherent in the memecoin market, which is often characterized by high volatility and speculative trading. Memecoins, typically created as a joke or based on internet memes, can attract significant attention and investment quickly. However, their lack of intrinsic value and susceptibility to market manipulation make them a risky investment.

For new and inexperienced investors, the BEER incident serves as a cautionary tale. It highlights the importance of conducting thorough research and being wary of projects that might be subject to manipulation. Investors should consider the transparency of a project’s team, the distribution of its token supply, and the overall market sentiment before committing funds.