Join Our Telegram Group

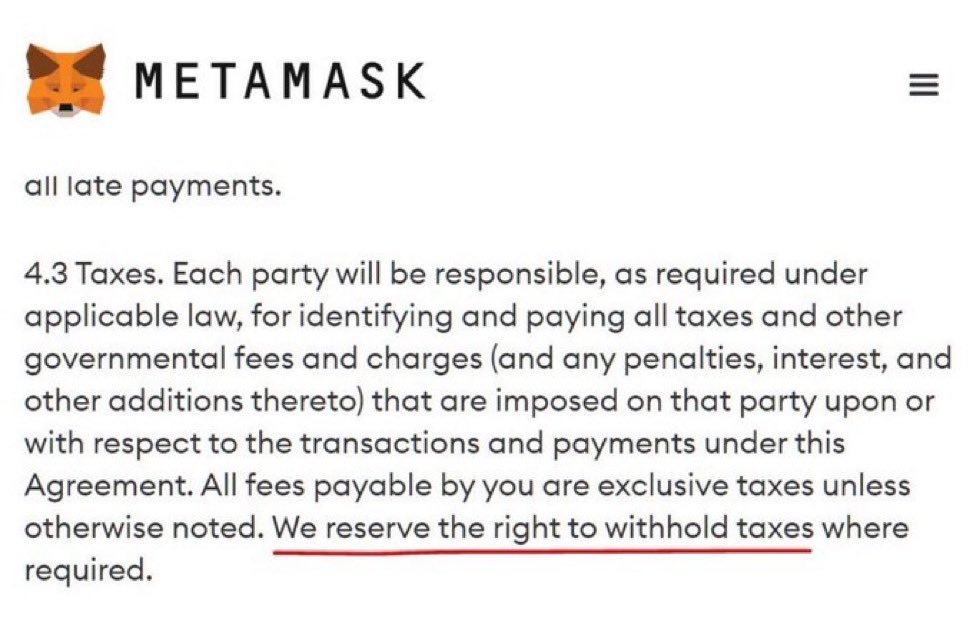

MetaMask, the popular digital wallet for cryptocurrency transactions, has recently been in the spotlight due to a new tax clause added to its Terms of Service (TOS). This clause has triggered significant discussions and misinformation within the cryptocurrency community.

What is the Tax Clause?

The tax clause in MetaMask’s Terms of Service states that the company reserves the right to withhold taxes on certain products and services it offers. It’s important to note that this clause specifically applies to users who make purchases of products or services from MetaMask. If you do not engage in any transactions involving the purchase of products or services, this tax clause does not affect you.

What Taxes Does It Refer To?

Contrary to some misinformation circulating online, the tax clause in MetaMask’s TOS does not pertain to capital gains taxes. Instead, it specifically addresses the taxes due on sales of services between users and MetaMask. In most cases, it is the responsibility of the service provider to collect and pay these taxes. MetaMask’s inclusion of this clause ensures compliance with applicable tax regulations and reflects their commitment to upholding legal obligations.

Understanding the Implications

MetaMask’s decision to include a tax clause in its Terms of Service aligns with the growing regulatory scrutiny surrounding cryptocurrency-related activities. By addressing the tax obligations related to the sales of services, MetaMask aims to promote transparency and ensure compliance with tax laws.

The implications of this tax clause are primarily relevant to users who engage in transactions involving the purchase of products or services from MetaMask. These users should be aware that taxes may be withheld on such transactions, and they should consider the potential impact on their overall costs.

Debunking Misconceptions

There has been some confusion and misconceptions regarding MetaMask’s tax clause. It is essential to separate fact from fiction to avoid unnecessary concerns. Let’s address a few common misconceptions:

Misconception 1: All MetaMask Transactions Are Subject to Taxes

Fact: The tax clause only applies to transactions involving the purchase of products or services from MetaMask. If you solely use MetaMask as a digital wallet to store and manage your cryptocurrencies without engaging in any purchases, this tax clause does not affect you.

Misconception 2: Capital Gains Taxes Are Included

Fact: MetaMask’s tax clause does not cover capital gains taxes. It specifically refers to taxes on sales of services between users and MetaMask. Capital gains taxes are generally subject to different regulations and are not within the scope of this particular clause.

Misconception 3: MetaMask Collects Taxes on Behalf of the Users

Fact: The responsibility of collecting and paying taxes typically falls on the service provider, not MetaMask. The tax clause ensures compliance with tax regulations and clarifies that users may be responsible for paying any applicable taxes on their transactions with MetaMask.

Conclusion

MetaMask’s new tax clause in its Terms of Service has sparked discussions and raised questions within the cryptocurrency community. By clarifying the purpose and scope of this clause, we hope to provide accurate information and debunk misconceptions. Remember, this tax clause specifically applies to users who make purchases from MetaMask, and it does not cover capital gains taxes. It is crucial to stay informed about the tax obligations associated with cryptocurrency transactions to ensure compliance with relevant laws and regulations.