Start your journey into this groundbreaking ruling as Ripple, prevails against the Securities and Exchange Commission (SEC) in a judicial tussle that lasted two grueling years. The verdict? XRP is classified as a virtual currency, sidestepping the convoluted regulations that come with securities. $XRP surge 25%

Ripple’s Fierce Arguments Brought To Light

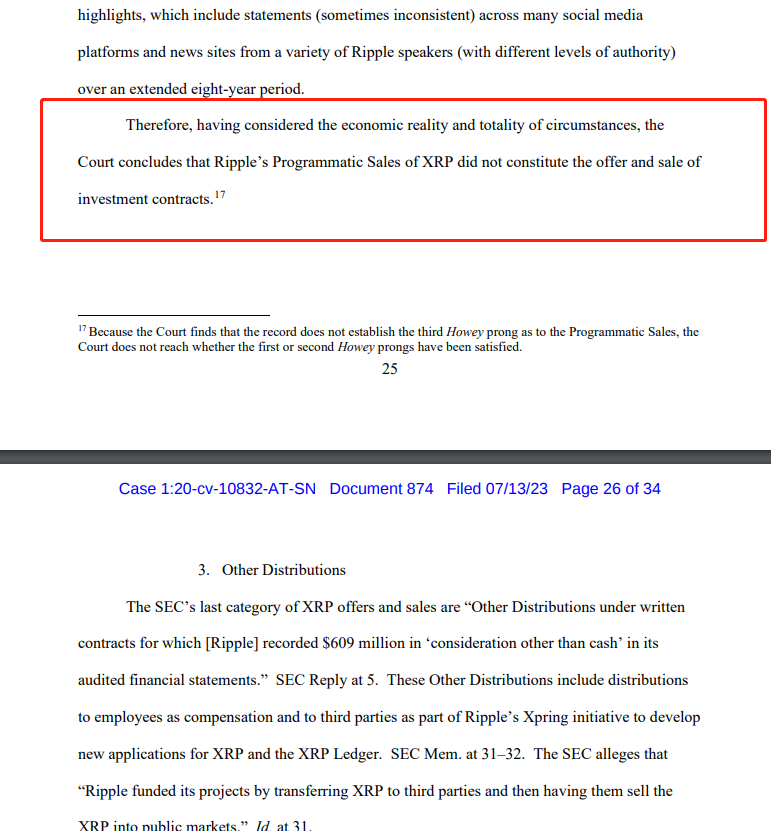

Brush up on Ripple’s determined refutations against the SEC’s attempted labelling of XRP as a security. Ripple highlighted the lack of factual dispute suitable for a trial, countering potential SEC action. In a bold move, Ripple also contested the SEC’s refusal to pinpoint a contractual foundation for a single XRP sale, a position aligning with their argument that the SEC had no case worthy of trial.

Intriguing Legal Questions About ‘Investment Contract’

Immerse yourself in gripping legal deliberations as Ripple highlights the ambiguity surrounding the term ‘investment contract’. The court concluded that this could indeed raise legal questions — namely, Ripple’s right to know whether their XRP distribution could be categorised under this term.

Ripple Challenges Securities Precedent

Explore Ripple’s claims about the absence of a precedent in U.S history where an asset’s secondary sale is deemed a security. Based on this argument, XRP is rightly classified as a commodity. This is a revelation that effectively counters the traditional understanding of securities.

Rest assured, you are getting the most accurate interpretation of this unfolding drama. This ruling, favoring XRP’s classification as a virtual currency, resonates far beyond Ripple, potentially altering the way we understand and engage with digital assets. Prepare to be enlightened, as this case stands to redefine the dynamics between cryptocurrencies and regulations.