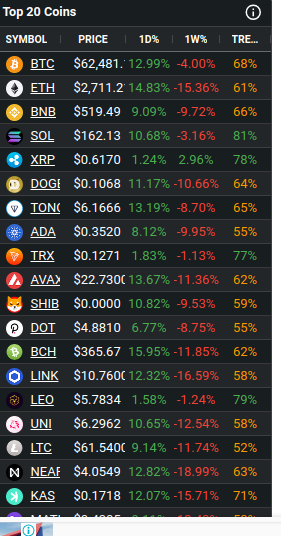

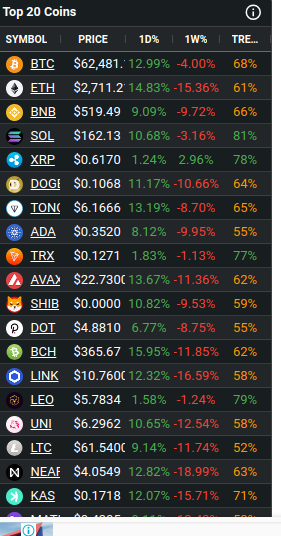

- BTC: Surged 12.99% today; down 4.00% this week.

- ETH: Gained 14.83% in 24 hours; lost 15.36% this week.

- SOL: Up 10.68% today; dropped 3.16% this week.

- XRP: Slight increase by 1.24% today; 2.96% growth this week.

In the past 24 hours, the top 20 cryptocurrencies have seen impressive gains, sparking discussions about a potential market rally. While the overall market sentiment leans bullish, the weekly trends show that this might be more of a short-term recovery than a lasting uptrend. Here’s a deeper dive into the current market dynamics and what they might mean for crypto investors.

24-Hour Surge After a Week of Struggles

Bitcoin (BTC), the king of cryptocurrencies, has risen by an impressive 12.99% in the last 24 hours. Despite this, BTC is still down 4.00% over the last week. This mixed performance highlights the volatility that has characterized the market recently. With a 68% bullish trend, there is optimism among investors, but caution remains due to the weekly loss.

Ethereum (ETH), following closely behind, recorded a significant 14.83% increase today. However, the leading altcoin also saw a 15.36% drop over the past week. The 66% bullish sentiment indicates a potential for recovery, but the sharp weekly decline suggests that the road ahead might still be bumpy.

Solana (SOL) also posted a 10.68% gain today, although it’s down 3.16% over the week. The 61% bullish trend shows a market that’s cautiously optimistic about SOL’s recovery, but the mixed signals over the past week keep traders on their toes.

XRP presents a different story with a more stable performance. It saw a modest 1.24% increase today and a 2.96% gain over the week, reflecting a 78% bullish sentiment. This stability could indicate XRP’s potential to weather recent market volatility better than others.

Broader Market Trends: A Short-Term Recovery?

The sudden surge in prices across the board, with double-digit gains for many top cryptocurrencies, suggests that the market might be experiencing a short-term rally. However, when viewed over the past week, the picture becomes more complex. Most of these assets are still recovering from significant losses, implying that this rally might not yet signify a full market reversal.

Binance Coin (BNB) and Dogecoin (DOGE) have both experienced strong daily gains of 9.09% and 11.71% respectively. Yet, their weekly losses of 9.77% for BNB and 10.66% for DOGE paint a picture of a market still grappling with recent declines. The 66% bullish trend for BNB and 64% bullish for DOGE indicate that while optimism is returning, it’s tempered by the reality of recent downturns.

TON and Avalanche (AVAX) saw 13.19% and 13.67% increases today, yet their weekly losses of 8.70% and 6.14% respectively highlight the challenges ahead. Both have bullish trends in the mid-60% range, which aligns with a cautiously optimistic outlook.

What This Means for the Market: Caution Amid Optimism

The recent surge across major cryptocurrencies could signal the beginning of a rally, but the mixed performance over the past week suggests it might be too early to declare a sustained uptrend. Investors should keep an eye on the market over the next few days to determine if this rally has staying power or if it’s simply a short-term recovery from recent lows.

Overall, while the market sentiment is leaning bullish, the underlying caution due to recent declines suggests that this optimism could be fragile. Traders and investors should proceed with careful optimism, watching for further signs that confirm whether this recovery will translate into a more extended bullish phase.