August 26, 2024 – The cryptocurrency market is experiencing a blend of short-term volatility and long-term optimism as several major digital assets fluctuate in price. As of today, leading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB) have seen minor daily declines but maintain strong performance over the past week.

Bitcoin and Ethereum Lead Market Movement

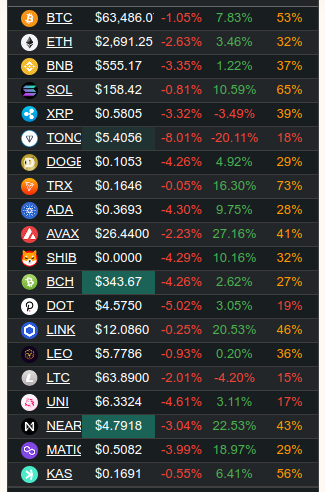

Bitcoin, the world’s largest cryptocurrency by market capitalization, is currently trading at $63,486, down by 1.05% over the past 24 hours. Despite this slight dip, Bitcoin has managed to secure a 7.83% gain over the week, indicating continued investor interest and bullish sentiment in the mid-term. Market analysts attribute this resilience to increased institutional interest and the upcoming Bitcoin ETF approvals, which are expected to boost demand further.

Ethereum, the second-largest cryptocurrency, is trading at $2,691.25, reflecting a 2.63% decrease over the last day. However, similar to Bitcoin, Ethereum has shown a positive weekly trend, rising by 3.46%. This can be attributed to ongoing developments in the Ethereum ecosystem, including advancements in its scalability solutions and the upcoming Ethereum 2.0 upgrades, which aim to improve the network’s efficiency and reduce gas fees.

Altcoins Show Varied Performance

The altcoin market has displayed varied performance, with some tokens showing resilience while others face downward pressure:

- Binance Coin (BNB) is trading at $555.17, down by 3.35% daily but up by 12.32% for the week. BNB’s robust weekly performance is likely driven by Binance’s continuous expansion and new product launches, which have bolstered investor confidence.

- Solana (SOL), known for its high-speed transactions and low fees, is trading at $158.42, a slight 0.81% drop today but an impressive 10.59% rise over the week. The strong weekly performance indicates growing adoption and positive sentiment among developers and users alike.

- Cardano (ADA) is another standout performer, currently priced at $0.3693. It has seen a daily decline of 4.30%, but its weekly gains of 9.75% suggest that investors remain optimistic about Cardano’s potential, especially with the anticipation of upcoming smart contract capabilities and ecosystem growth.

- Polygon (MATIC) and NEAR Protocol have also captured attention with significant weekly increases of 19.97% and 22.53%, respectively. These gains highlight the market’s focus on Layer 2 solutions and next-generation blockchain platforms that promise improved scalability and lower costs.

Market Sentiment and Outlook

Overall, market sentiment remains mixed, with many traders exercising caution in the short term due to recent price fluctuations. However, the positive weekly performance across most cryptocurrencies reflects a broader bullish trend and confidence in the future of digital assets. The market appears to be in a phase of consolidation, with investors closely monitoring macroeconomic factors and regulatory developments that could impact the market dynamics.

Conclusion

The cryptocurrency market is currently navigating through a period of short-term uncertainty with daily price corrections, yet the weekly performance of major and emerging cryptocurrencies indicates strong underlying fundamentals and continued growth potential. As the market evolves, traders and investors are advised to stay informed on the latest developments and adjust their strategies accordingly.