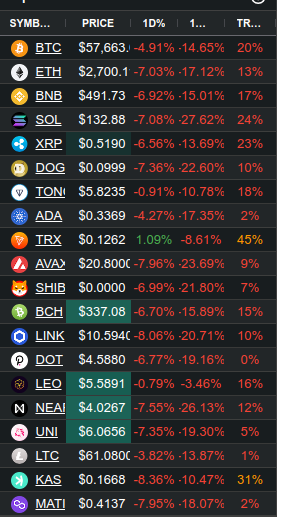

The cryptocurrency market is experiencing a dramatic downturn, with significant losses across the board. Bitcoin (BTC), the flagship cryptocurrency, has plummeted to $57,663, marking a 14.65% decline over the past week. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has not been spared, dropping to $2,700, down 17.12% over the same period.

Market-Wide Declines

The losses extend beyond Bitcoin and Ethereum. Other major cryptocurrencies are also feeling the pinch:

- Binance Coin (BNB): Down 15.01% to $491.73

- Solana (SOL): Down 17.26% to $132.88

- XRP: Down 23.29% to $0.5190

- Dogecoin (DOGE): Down 22.60% to $0.0999

- Cardano (ADA): Down 17.35% to $0.3369

The overall market sentiment is bearish, with many investors worried about the long-term implications of this downturn.

Is This the End?

While the current situation looks grim, seasoned investors know that volatility is inherent in the cryptocurrency market. Historically, the market has experienced similar downturns, only to recover and reach new highs. The question on everyone’s mind is whether this is just another dip or the beginning of a prolonged bear market.

A Buying Opportunity?

For some, this crash presents a buying opportunity. Investors with a long-term perspective may see the current prices as discounts on their favorite cryptocurrencies. Dollar-cost averaging (DCA) is a popular strategy in such times, allowing investors to accumulate assets gradually without trying to time the market.

Expert Opinions

Financial experts and crypto analysts are divided on what comes next. Some believe that the market will stabilize and recover as it has in the past, driven by strong fundamentals and continued adoption. Others warn of further declines, citing macroeconomic headwinds and regulatory uncertainties.

Conclusion

The current crypto market freefall is a stark reminder of the volatility inherent in digital assets. Whether this is the end of the bull run or a prime buying opportunity is yet to be seen. Investors should proceed with caution, stay informed, and consider their risk tolerance before making any decisions.