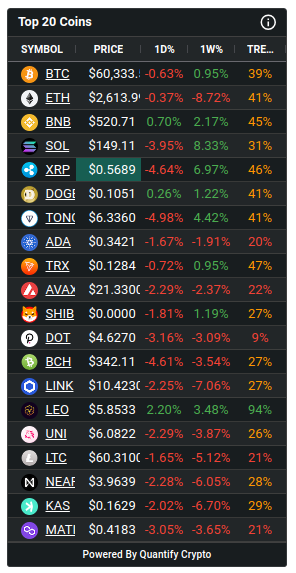

- Bitcoin slips by 0.63% over 24 hours, up 0.95% for the week

- Ethereum sees a 0.37% daily drop, loses 8.72% this week

- Solana and XRP show strong weekly gains despite daily losses

- Market trend indicators suggest mixed sentiment with no clear direction

The cryptocurrency market is currently exhibiting signs of uncertainty, with mixed performances across the board. Key players like Bitcoin and Ethereum are experiencing slight declines, while altcoins such as Solana and XRP have shown potential for recovery despite recent setbacks.

Dominant Coins Under Pressure

Bitcoin (BTC), the flagship cryptocurrency, has seen a slight dip of 0.63% in the last 24 hours, although it still managed a modest 0.95% gain over the past week. This mixed performance suggests that BTC may be in a consolidation phase, with traders awaiting clearer signals before making significant moves.

Similarly, Ethereum (ETH) has faced a minor daily loss of 0.37%. However, it has suffered a more considerable drop of 8.72% over the week. This sharp decline could be attributed to profit-taking following recent rallies or broader market concerns impacting altcoins. Ethereum’s performance is closely watched by traders, as its fluctuations often signal broader market trends.

Altcoins: Solana and XRP Show Potential

While Bitcoin and Ethereum struggle with pressure, some altcoins have shown resilience. Solana (SOL), despite a 3.95% drop in the past 24 hours, has posted an impressive 8.33% gain over the week. This pattern indicates that SOL might be experiencing profit-taking after a period of strong performance, a common occurrence in the volatile crypto market.

XRP (Ripple) shares a similar story, with a 4.64% loss in the last 24 hours but a robust 6.97% gain over the week. These numbers suggest that XRP, like SOL, may be undergoing a short-term correction after significant gains, potentially positioning itself for a recovery if the broader market sentiment improves.

On the flip side, coins like Avalanche (AVAX), Bitcoin Cash (BCH), and Polygon (MATIC) are showing consistent negative trends both daily and weekly, indicating sustained bearish momentum. This continued downward pressure may reflect growing investor concerns or technical sell signals that are keeping these assets in a downtrend.

Market Sentiment: A Mixed Bag

The market trend strength indicators for these top cryptocurrencies range between 30% to 50%, signaling moderate trends without strong directional movements. This suggests that the market is in a consolidation phase, where traders are unsure of the next significant move. The mixed daily and weekly performances across major coins indicate a volatile market, which can create opportunities for both short-term traders and long-term investors.

Opportunities Amid Volatility

Given the current market conditions, traders might find opportunities in altcoins like Solana and XRP, which have shown strong weekly performance despite recent daily setbacks. These coins could be poised for further gains if they stabilize and resume their upward trends.

Meanwhile, Bitcoin and Ethereum’s performance will likely remain a bellwether for the broader market, with any significant shifts in these leading cryptocurrencies potentially setting the tone for the entire crypto space.

Conclusion

As the crypto market navigates through this period of mixed sentiment and moderate trends, cautious optimism seems to be the prevailing mood among traders. While no clear direction has emerged, the market’s volatility could present opportunities for those ready to capitalize on short-term movements or position themselves for potential breakouts.

For now, all eyes are on the major cryptocurrencies and key altcoins, with traders waiting for the next big move that could signal a shift in market dynamics.