- 🟩 Net Inflow: +$32.58M

- 💰 Total Traded Value: $7.00B

- 🏦 Total Net Assets: $54.35B

- 📊 ETF Market Value Ratio: 4.65%

Investors Stay Bullish on Bitcoin ETFs

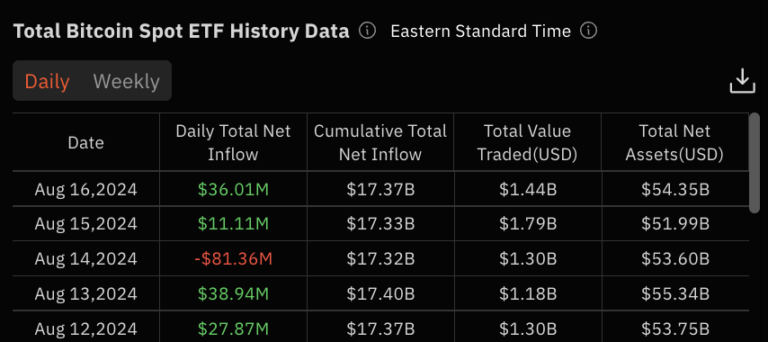

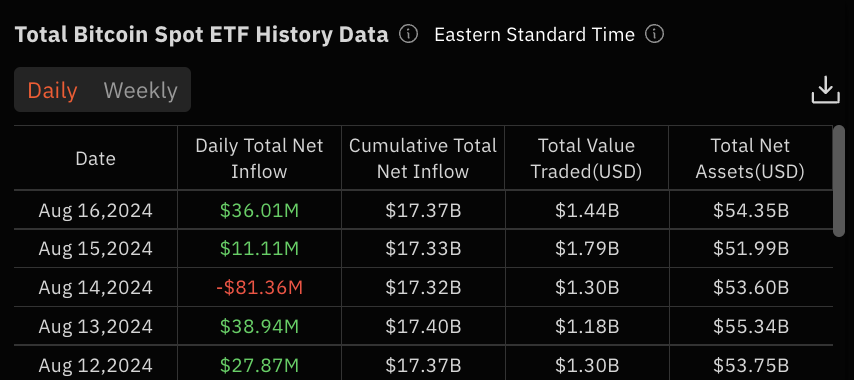

This week, Bitcoin ETFs showed surprising strength, bringing in a solid $32.58 million in net inflows. The total traded value across all ETFs hit $7 billion, with the market still holding strong at $54.35 billion in total net assets. The ETF market value ratio of 4.65% reflects a stable interest in Bitcoin funds.

However, not everything was rosy. Grayscale’s GBTC experienced a huge outflow of $195.22 million, shaking things up. Despite this, other ETFs managed to pick up the slack.

Top Performers: Fidelity and iShares Shine

Fidelity’s FBTC ETF emerged as the star of the week, pulling in $82.11 million. iShares’ IBIT wasn’t far behind, with a $71.07 million inflow. ARK’s ARKB and ProShares’ BTC also had a good run, adding $35.99 million and $21.51 million, respectively.

Even some of the smaller ETFs like BITB and EZBC saw positive inflows, contributing $11.97 million and $5.15 million. On the other hand, several ETFs such as BTCW, HODL, BTCO, BRRR, and DEFI remained flat with no net movement.

Despite the big outflow from GBTC, the overall positive inflows across other ETFs suggest that investor confidence in Bitcoin is still strong. The market’s ability to absorb GBTC’s losses and still post a net gain highlights the growing diversification and resilience in the Bitcoin ETF space.

SOURCE: SOSOVALUE