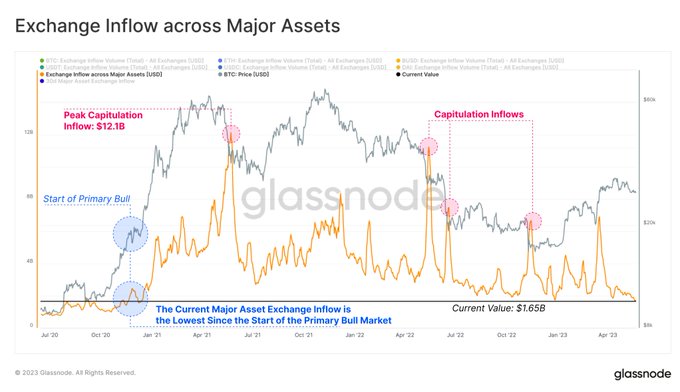

In recent reports, Glassnode, a leading blockchain data and intelligence provider, has highlighted a concerning trend in the cryptocurrency market. The influx of major assets into exchanges has reached a cyclical low of $1.65 billion, marking the lowest value since the primary Bull Market began.

This decline in asset inflows carries significant implications, as exchanges serve as the primary destination for market speculation. It sheds light on the prevailing issue of structural market liquidity, which remains at an exceptionally low level. Furthermore, the removal of prominent market makers such as Jane Street and Jump Crypto further compounds this liquidity challenge. With an increasingly illiquid market and thin order books, the likelihood of market volatility significantly increases.

https://studio.glassnode.com/dashboards/mrkt-capital-rotation

Understanding Structural Market Liquidity

The current state of structural market liquidity is a cause for concern among investors and market participants alike. Structural market liquidity refers to the ability of an asset to be bought or sold without significantly impacting its price. In simpler terms, it indicates how easily an investor can enter or exit a position in a particular market. When liquidity is high, there is an abundance of buyers and sellers, resulting in smooth transactions and minimal impact on asset prices. Conversely, when liquidity is low, trading volumes decrease, and even relatively small buy or sell orders can cause significant price movements.

Reasons behind the Decline in Asset Inflows

Several factors contribute to the decline in asset inflows into exchanges. One significant factor is the increased regulatory scrutiny and uncertainty surrounding the cryptocurrency market. Governments and regulatory bodies worldwide have intensified their efforts to establish guidelines and frameworks for digital assets. This heightened regulatory environment has led to a sense of caution among investors, prompting them to hold onto their assets rather than actively trading them.

Additionally, market participants may be shifting their focus to alternative investment opportunities within the cryptocurrency space. The rise of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) has captured the attention of many investors. These innovative areas offer different avenues for potential returns, which may divert assets away from traditional exchanges.

Moreover, the recent exit of prominent market makers, including Jane Street and Jump Crypto, has further exacerbated the liquidity challenge. Market makers play a crucial role in providing liquidity by continuously quoting bid and ask prices. Their absence reduces the overall liquidity in the market, making it harder for investors to enter or exit positions at desirable prices.

Impact on Investors and Market Volatility

The decline in asset inflows and the resulting liquidity challenges have a significant impact on investors. With limited liquidity, investors may find it increasingly difficult to execute large trades without significantly impacting market prices. Thin order books and reduced trading volumes can lead to increased slippage, where the execution price deviates unfavorably from the expected price. This can erode the profitability of trades and hinder effective risk management.

Furthermore, the lack of liquidity and the potential for market volatility can expose investors to heightened risks. Illiquid markets are more susceptible to manipulative activities and price manipulation attempts. The absence of sufficient buyers or sellers can enable large market participants to move prices in their favor, causing artificial price swings. This volatility introduces uncertainty and can deter potential investors who are seeking stable and predictable markets.

The Need for Ethical Behavior and Investor Protection

Amid allegations of market manipulation and the challenges posed by declining asset inflows, there is a pressing need for ethical behavior and investor protection. Regulatory bodies and industry stakeholders must work together to establish robust frameworks that foster fair and transparent markets. Increased transparency in trading activities, stricter oversight of exchanges, and enhanced measures to prevent market abuse are crucial steps toward restoring investor confidence.

Investors, on their part, should exercise caution and conduct thorough research before engaging in any investment activity. Understanding the risks associated with illiquid markets and implementing sound risk management strategies can help mitigate potential losses. Additionally, staying informed about regulatory developments and market trends enables investors to make more informed decisions and adapt to changing market conditions effectively.