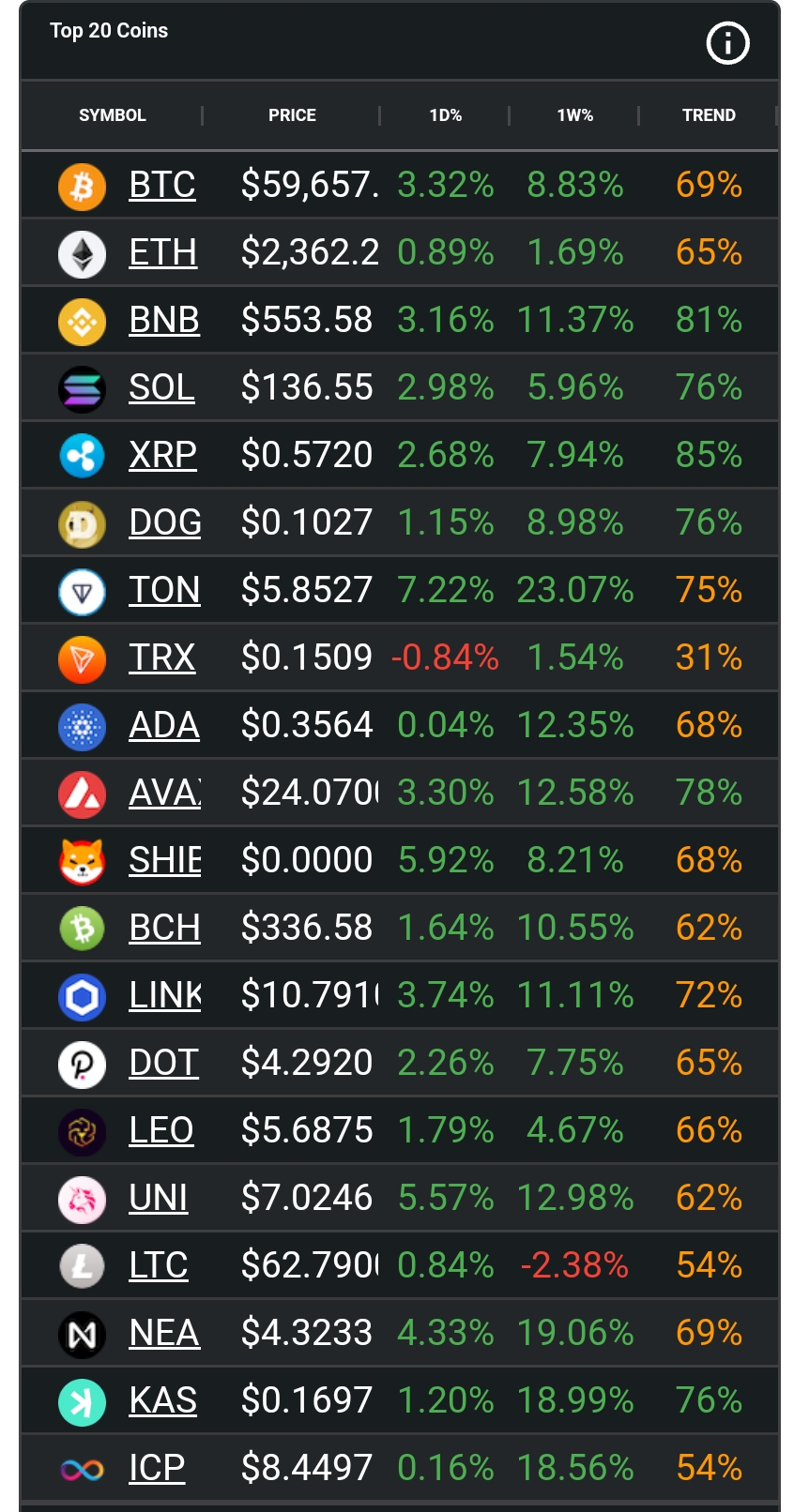

- Bitcoin spot ETFs gained $37.11M in net inflows on July 18.

- Grayscale’s GBTC faced a net outflow of $22.55M.

- BlackRock’s IBIT led with a $102.67M daily net inflow.

- Total net asset value of Bitcoin spot ETFs now $57.20B.

Bitcoin spot ETFs experienced a significant net inflow of $37.11 million on July 18, 2024, marking ten consecutive days of positive inflows. This trend underscores growing investor confidence and interest in Bitcoin ETFs, particularly as a mainstream investment vehicle.

Major Players in Bitcoin ETF Inflows

BlackRock’s IBIT led the charge with a staggering daily net inflow of $102.67 million. This inflow pushed IBIT’s total historical net inflow to $18.85 billion, reinforcing its position as a dominant player in the Bitcoin ETF market. BlackRock’s success highlights the increasing institutional interest in Bitcoin, driven by its comprehensive investment strategies and robust market positioning.

Fidelity’s FBTC also showed positive momentum, recording a daily net inflow of $2.78 million. This addition brought FBTC’s total historical net inflow to $9.82 billion. Fidelity’s consistent performance in the Bitcoin ETF space showcases its strong market presence and the trust it garners from investors.

In contrast, Grayscale’s ETF GBTC experienced a net outflow of $22.55 million, contributing to a total historical net outflow of $18.71 billion. This decline suggests that investors might be reallocating their assets towards other more promising Bitcoin ETFs.

Overall Bitcoin ETF Market Dynamics

As of the latest data, the total net asset value (NAV) of Bitcoin spot ETFs stands at $57.20 billion. The ETF net asset ratio, which is the market value relative to the total market value of Bitcoin, has reached 4.54%. The historical cumulative net inflow for Bitcoin spot ETFs now totals $16.63 billion.

These figures illustrate the significant impact of Bitcoin ETFs on the broader cryptocurrency market. The continuous inflows into Bitcoin ETFs indicate a robust demand and growing acceptance of Bitcoin as a viable investment asset.

Future Outlook for Bitcoin ETFs

The future of Bitcoin spot ETFs looks promising, given the current market dynamics and investor sentiment. As more institutional investors enter the market, the inflows are expected to continue. Moreover, the growing adoption of Bitcoin as a mainstream investment asset will likely drive further interest in Bitcoin ETFs.

Investors should keep an eye on key players like BlackRock and Fidelity, as their strategies and market movements can provide valuable insights into the overall market trends. Additionally, monitoring regulatory developments will be crucial in understanding the future trajectory of Bitcoin ETFs.

For more detailed insights and up-to-date information on Bitcoin spot ETFs, visit SoSoValue.