Bitcoin, the leading cryptocurrency, encountered a significant hurdle this week as it reached a new yearly high of $44500 before facing the third sharpest sell-off of the year 2023. The strong price appreciation over recent months has triggered a response from Bitcoin Short-Term Holders, who have seized the opportunity to take profits at a statistically significant magnitude.

- Bitcoin Price Movement:

- Bitcoin experienced resistance at a new yearly high of $44.5k before a sharp selling off, closing at $40.2k.

- The market witnessed significant fluctuations, with rallies over +5.0%/day into the yearly high and a -5.75% drop in one day.

- Investor Response and Market Performance:

- Bitcoin has seen a standout year, up over 150% YTD, prompting a pause in the climb as investors respond to their gains.

- Short-Term Holders have taken profits at a statistically meaningful magnitude, influencing the market.

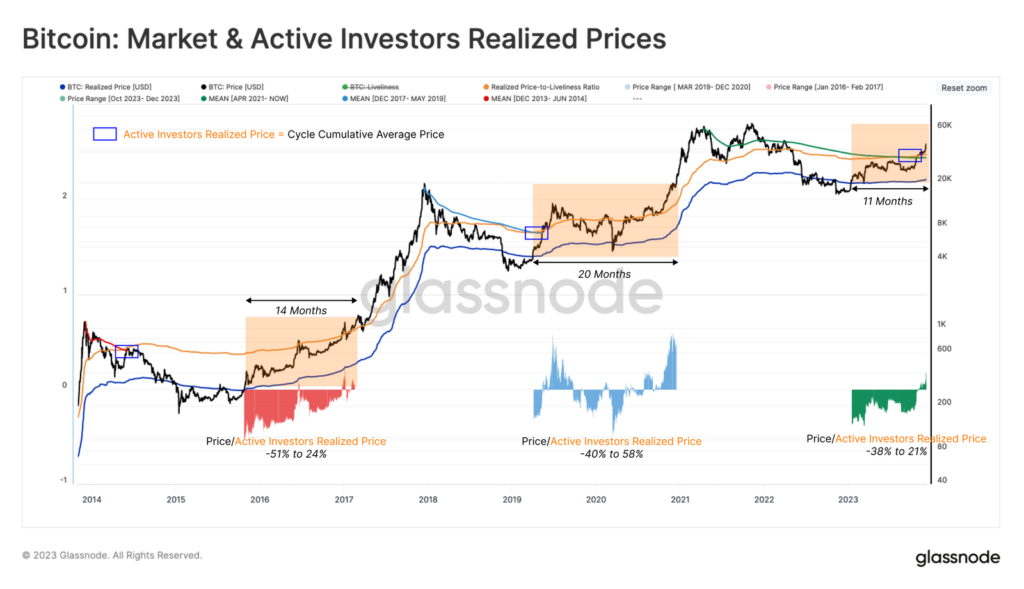

- On-chain Pricing Models:

- The Active Investor Realized Price computes a ‘fair value’ of Bitcoin based on supply tightness, currently at ~$36k.

- The Mayer Multiple and NVT Price models provide indicators for overbought, oversold, and ‘overvaluation’ signals.

- Influence of Short-Term Holders:

- Short-Term Holders impact near-term price action, with indicators suggesting potential ‘overheating’ and profit-taking activity.

- Fear and Greed Among New Investors:

- A tool is being developed to identify periods of heightened fear and greed among newer investors, influencing market behavior.

- Metrics indicate ‘buy-the-dip’ patterns and higher-risk structure.

- Realized Profit/Loss by Short-Term Holders:

- Short-Term Holders have realized profits during the rally to $44.2k, taking advantage of demand liquidity.

- High loss-taking activity suggests panic selling during major sell-off events.

- STH Profit-Taking:

- The recent rally to $44.2k was accompanied by a meaningful degree of profit-taking by STHs.

- On-chain data suggests STHs are a key driver in the rally.