Regulating the Digital Frontier: Elizabeth Warren’s Crusade for Crypto Compliance

The cryptocurrency industry, a domain once heralded as the beacon of decentralized finance, is standing at the crossroads of transformative regulation. Spearheaded by US Senator Elizabeth Warren, a new bill introduced could redefine the very foundations of cryptocurrency operations and their adherence to compliance protocols.

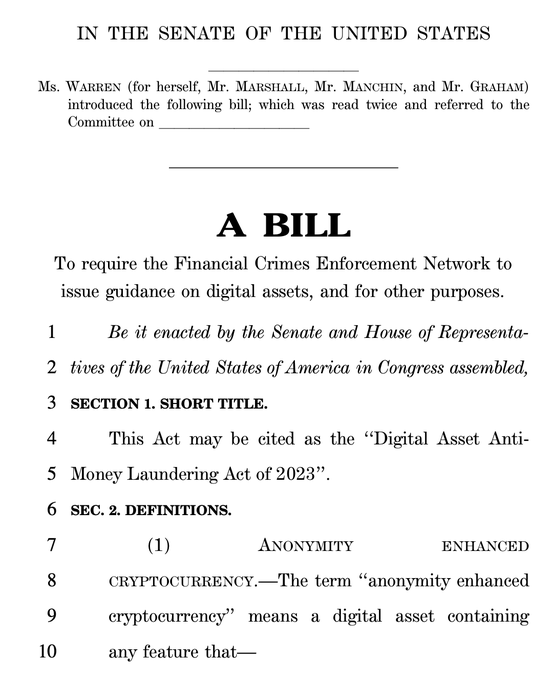

The Digital Asset Anti–Money Laundering Act of 2022: A Synopsis

In an audacious legislative move, Senator Warren, in collaboration with Senator Roger Marshall, has unveiled the Digital Asset Anti–Money Laundering Act of 2022. The proposed legislature is not just another policy amendment; it’s a clarion call for uniform compliance akin to the traditional financial sector’s regulatory frameworks.

Under the Legislative Microscope: Crypto’s Role in Global Crime

The premise of the bill pivots on cryptocurrency’s alleged facilitation of illicit activities. In Senator Warren’s perspective, the shadows of global crime loom over the digital currency landscape, with crypto’s anonymity features providing a veil for terrorists, rogue states, and criminal syndicates.

Closing Loopholes: The Equalization of Financial Oversight

Senator Warren’s bill is a leviathan of regulation that seeks to vanquish the perceived loopholes in the crypto domain. The ‘same transaction, same risk, same rule’ philosophy underpins this legislative foray, with the intent to impose stringent know-your-customer (KYC) requirements on all echelons of the crypto industry – from miners to wallet providers.

Reactions from the Cryptosphere: Industry and Experts Weigh In

The response from the cryptocurrency industry to Senator Warren’s legislative proposal has been swift and potent. Critics argue the blanket imposition of anti-money laundering (AML) regulations on software developers and node operators may represent an overreach, potentially stifling innovation and compromising privacy.

Balancing Act: Security Versus Privacy in Crypto Transactions

A salient point of contention is the balance between ensuring security and preserving user privacy. The bill’s detractors, including legal experts and crypto think tanks, warn against the risks of eroding fundamental rights under the veil of regulatory compliance.

A Catalyzing Force for Change or a Damper on Innovation?

While intended to safeguard the financial system, there is an ongoing debate about whether the aggressive stance on regulation might inadvertently curb the innovative spirit that characterizes the cryptocurrency world.

Looking Ahead: The Bill’s Trajectory and Its Impacts

As the bill makes its way through the legislative maelstrom, its implications loom large for the future of cryptocurrency. The crypto industry could be bracing for an upheaval that heralds a new era of transparency and accountability.

The Inevitability of Evolution in Cryptocurrency Oversight

With the issues surfacing from the FTX debacle, and heightened scrutiny from regulatory agencies, the evolution of cryptocurrency oversight seems not just imminent but necessary. Senator Warren’s bill could potentially be the harbinger of a more regulated, and perhaps more resilient, digital asset market.

Bridging the Crypto-Regulatory Divide: A Possible Future

The aftermath of legislative actions like Senator Warren’s bill could lead to a pivotal transformation, bridging the gulf between the crypto-anarchist roots of digital assets and the structured world of federal oversight.

Conclusion: Navigating the Next Chapter in Crypto Regulation

As the narrative unfolds, one thing is clear – the discourse surrounding Senator Elizabeth Warren’s bill is set to shape the trajectory of the cryptocurrency industry profoundly. Whether as a draconian clampdown or a step towards maturation, the outcome will be instrumental in charting the future interactions between digital assets and global finance.