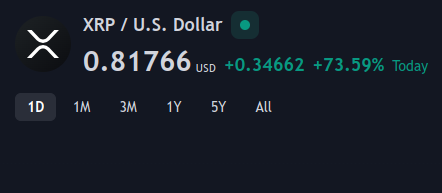

In the dynamic and ever-evolving world of cryptocurrencies, regulatory clarity plays a crucial role in shaping the market. Recently, Ripple’s XRP US federal judge made a groundbreaking court ruling, determining that it should not be classified as a security. This decision has had a profound impact, leading to a remarkable 70% surge in the price of XRP. In this article, we will delve into the details of the court ruling, its implications for Ripple and the wider cryptocurrency industry, and what the future might hold.

The SEC vs. Ripple Case: A Legal Battle in the Crypto Community

For quite some time, the legal battle between Ripple and the Securities and Exchange Commission (SEC) has captivated the crypto community. The SEC alleged that Ripple’s sales of XRP violated securities laws by constituting unregistered securities offerings. On the other hand, Ripple argued that the lack of clear regulatory guidance made it difficult to determine the legal status of XRP in the rapidly evolving crypto landscape.

Judge’s Ruling: A Partial Win for Ripple and the SEC

The recent court ruling in the SEC vs. Ripple case delivered a mixed outcome for both parties involved. The federal judge’s decision acknowledged that institutional sales of XRP could be considered unregistered securities. However, the judge made a crucial distinction, stating that programmatic sales conducted on exchanges did not fall under the same classification. This differentiation recognized the nature of programmatic sales as being similar to secondary trading.

Implications for the Crypto Industry: Hope and Clarity

The court’s ruling has sparked hope among cryptocurrency investors and enthusiasts alike. It has opened the door to the possibility that other cryptocurrencies may also avoid classification as securities. This development carries significant implications for ongoing SEC cases and provides much-needed clarity on the distinction between securities and commodities in the realm of digital assets. Moreover, the ruling has triggered proactive responses from major cryptocurrency exchanges.

Coinbase and Gemini’s Response: Resumption of XRP Trading

In the wake of the court ruling, Coinbase, a leading cryptocurrency exchange, announced its decision to resume trading of XRP. This move reinstated Coinbase’s support for the XRP token and reflected the market’s growing optimism and confidence in its future prospects. Similarly, Gemini, another prominent exchange, expressed its interest in listing XRP, further emphasizing the positive sentiment surrounding Ripple’s victory in the case.