In a dramatic turn of events, the US stock market experienced a significant downturn today, with over $900 billion wiped out in a single trading session. The market saw widespread selling pressure across various sectors, causing major indices to plummet.

Market Overview

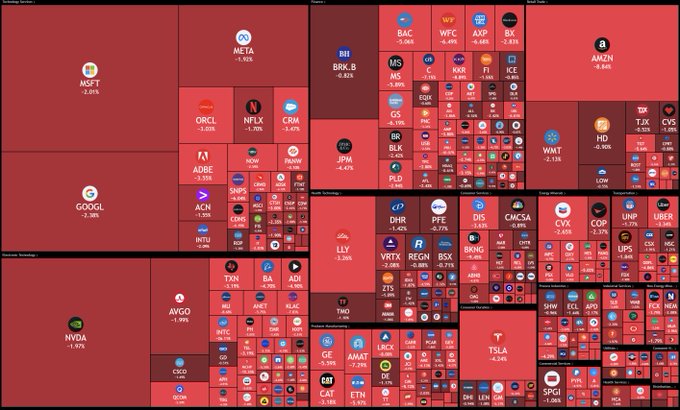

The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closed the day deep in the red. The S&P 500 fell by 3.2%, while the Dow Jones Industrial Average dropped by 2.8%, and the Nasdaq Composite declined by 3.5%. This sharp decline has led to substantial losses in market capitalization, impacting a wide range of industries.

Key Factors Behind the Decline

Several factors contributed to this massive sell-off:

- Economic Data: Disappointing economic data releases indicated slower growth and higher-than-expected inflation, leading to fears of an economic slowdown.

- Interest Rate Concerns: The Federal Reserve’s indication of potential future interest rate hikes to combat inflation has spooked investors, leading to a flight from equities.

- Geopolitical Tensions: Rising geopolitical tensions in various parts of the world have added to the market’s uncertainty, prompting investors to seek safer assets.

Sector Impact

- Technology: The tech sector was one of the hardest hit, with major companies like Microsoft, Apple, and Google seeing significant declines. The tech-heavy Nasdaq Composite bore the brunt of the sell-off.

- Financials: Financial stocks also saw substantial losses, with major banks and financial institutions losing ground amid fears of an economic slowdown.

- Consumer Discretionary: Retail giants and consumer discretionary stocks were not spared, with companies like Amazon and Tesla experiencing notable declines.

Investor Sentiment

Investor sentiment has turned bearish as concerns over economic growth and inflation take center stage. The volatility index (VIX), often referred to as the “fear gauge,” spiked sharply, indicating heightened investor anxiety.

Expert Opinions

Market analysts are divided on the outlook. Some believe this correction was overdue given the extended bull market and high valuations, while others are concerned about the potential for further declines if economic conditions do not improve.

Looking Ahead

Investors will be closely watching upcoming economic data and Federal Reserve statements for further guidance. Market participants are also hoping for stabilization in geopolitical situations to help restore confidence.

Conclusion

Today’s market rout has erased over $900 billion in value from the US stock market, reflecting deep investor concerns about economic and geopolitical stability. As markets digest these losses, the focus will shift to future data releases and central bank policies to gauge the longer-term direction of the market.

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Always consult with a financial advisor before making any investment decisions.