Japanese investment firm Metaplanet has made headlines once again by significantly increasing its Bitcoin holdings. Known as the “MicroStrategy of Japan,” the Tokyo-listed company recently added 20.381 BTC to its portfolio, raising its total holdings to approximately 247 BTC. This strategic move has resulted in a notable uptick in its stock price, which surged by 20%.

A Closer Look at Metaplanet’s Bitcoin Holdings

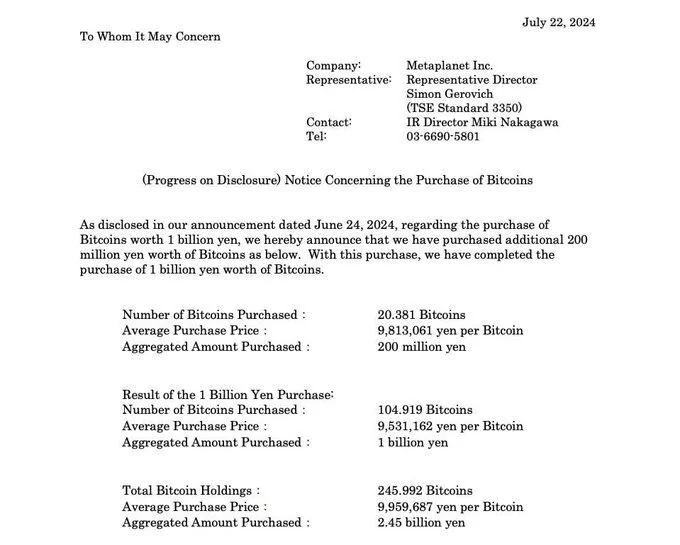

On July 16, Metaplanet held 226.611 BTC. With the recent addition, its holdings have now increased to 246.992 BTC. This consistent accumulation of Bitcoin is a testament to the firm’s confidence in the cryptocurrency’s long-term value.

Impact on Stock Performance

Metaplanet’s aggressive Bitcoin strategy has paid off handsomely. Following the latest purchase, the company’s stock experienced a remarkable 20% rise. This boost is part of a broader trend where Metaplanet’s shares have soared by over 800% year-to-date, reflecting investor optimism and the firm’s strong market positioning.

Strategic Implications

Metaplanet’s approach mirrors the strategy employed by MicroStrategy in the US, which has also seen substantial gains through its Bitcoin investments. By continually increasing its Bitcoin holdings, Metaplanet not only diversifies its asset base but also capitalizes on the growing acceptance and potential appreciation of digital currencies.

Metaplanet’s recent purchase of 20.381 BTC is a clear indicator of its ongoing commitment to cryptocurrency. This strategic move has not only bolstered its Bitcoin reserves but also significantly boosted its stock performance, underscoring the company’s innovative investment strategy and robust market outlook.