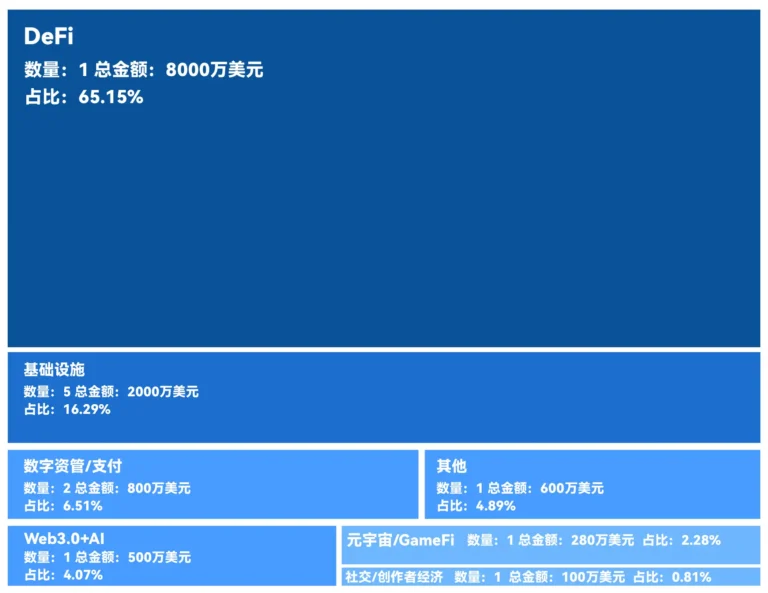

According to BlockBeats statistics, the total number of financings last week was 12, which is less than before, with a total amount of approximately US$122.8 million and an average financing amount of US$10.23 million.

Infrastructure is the main sector, digital asset management is relatively more, and NFT is not available yet. The following figure shows the proportion of financing in each sector last week:

Infrastructure, Metaverse/GameFi, Financing in other fields, Digital asset management/payment, NFT/digital fashion, DeFi, Social/creator economy, Web3.0+AI

Metaverse/GameFi

There was a total of 1 financing in the Metaverse/GameFi field, with a total amount of US$2.8 million, accounting for 2.28% of the total financing last week. Including:

CryptoHunter World

On September 3, the P2E blockchain gaming platform CryptoHunter World announced the completion of a $2.8 million private round of financing, with participation from IOST, HG Ventures, Mindfulness Capital, Bigcandle Capital, Web3Wave and Layer-OTC. The new funds will support its construction of a blockchain RPG game, which is scheduled to be released in closed beta between September and October.

The P2E (Play-to-Earn) blockchain gaming platform is a gaming platform based on blockchain technology that allows players to earn actual crypto-asset rewards by playing games. This model is different from the traditional “playing games for entertainment”. The P2E platform combines games with the blockchain economy, allowing players to earn income through in-game activities, tasks or transactions.

DeFi

There was a total of 1 financing in the DeFi field, with a total amount of over 80 million US dollars, accounting for 65.15% of the total financing last week. Including:

Pencils Protocol

On September 2, according to official news, the Scroll ecosystem project Pencils Protocol completed a new round of financing with a valuation of US$80 million, with Taisu Ventures, DePIN X, Bing Ventures and Black GM Capital participating. Previously in May this year, Pencils Protocol completed a seed round of financing of US$2.1 million, with investors including OKX Ventures, Animoca Brands, Galxe, Gateio Labs, Aquarius, Presto and other well-known institutions and individual investors.

Pencils Protocol is currently the native project ranked first in TVL in the Scroll ecosystem. It is a multi-functional DeFi protocol that is committed to providing users with diversified decentralized applications (DApps) and financial services. It is a one-stop yield aggregator and auction platform based on Scroll, including asset aggregation and distribution, leveraged income, auctions and other functions, aiming to maximize users’ asset utilization.

Social/Creator Economy

There was a total of 1 financing in the social/creator economy field, with a total amount of approximately US$1 million, accounting for 0.51% of the total financing last week. Including:

Blabla

On September 8, BlaBla, a decentralized SocialFi video platform based on the Morse ecosystem, announced the completion of its seed round of financing. Nebula lnvestment, Blockchain Association of Europe (BCAEU), Hopechain and others participated in the investment. The specific amount and valuation data have not been disclosed yet.

BlaBla plans to use the new funds to build its decentralized model and transparent reward system. BlaBla was founded by former members of the TikiTok and Meta teams. BlaBla breaks the boundaries of traditional video platforms by implementing a decentralized model and a transparent reward system, allowing every user and creator to get their fair share. Users earn tokens by watching, interacting, and sharing content, while creators benefit from direct tips provided by users.

Infrastructure

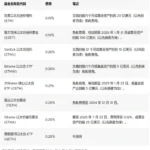

There were 5 financings in the infrastructure sector, with a total amount of over 20 million US dollars, accounting for 16.29% of the total financing last week. Including:

Space and Time

On September 4, Gate Ventures announced that it has made a strategic investment in Space and Time (SxT) to participate in its Series A financing. The Series A financing was officially announced on Tuesday, August 27, 2024, and will advance SxT’s mission in building and scaling AI-driven decentralized data infrastructure. The Series A financing will be used to enhance SxT’s innovative data platform, which is designed to provide verifiable and trustless data services. The SxT team is composed of world-class AI and cryptography researchers who plan to accelerate product development, expand global influence, and strengthen partnerships in the blockchain field.

Space and Time is a decentralized data platform that aims to combine blockchain data with traditional enterprise data to provide verifiable, real-time query services for dApps. It enables developers to process and analyze large-scale data in a decentralized environment by introducing a decentralized data warehouse, while ensuring the transparency and security of the data. Space and Time also supports smart contracts to help developers call and verify data directly on the blockchain, so that on-chain and off-chain data can be seamlessly integrated. It solves the problem of large-scale data management and verification in blockchain applications. This investment is expected to have a profound impact on the Web3 ecosystem. With the support of Gate Ventures, SxT will continue to drive AI innovation by providing developers with key data, infrastructure, and tools.

Hypernative

On September 3, Web3 security company Hypernative completed a $16 million Series A financing round. Another Web3 security company Quantstamp led this round of financing, and companies such as Bloccelerate VC, Boldstart Ventures, Borderless Capital, CMT Digital, IBI Tech Fund, and Re7 Capital also participated.

Hypernative is a company that focuses on providing risk management and threat detection solutions in the blockchain and crypto space. It helps projects and institutions prevent possible security threats and financial risks by monitoring on-chain and off-chain data. Hypernative’s technology monitors blockchain transactions, smart contracts, and market dynamics through machine learning and data analysis, and can quickly identify abnormal activities or possible attacks. This allows project owners, trading platforms, and investors to take preventive measures before security risks occur.

In short, the core of Hypernative is to provide an intelligent security protection system for the blockchain and encryption industry, aiming to detect and prevent security threats in advance.

The remaining infrastructure financing includes:

On September 2, Ethereum Layer 2 solution Kroma completed its Series A financing. The specific amount has not been disclosed. This round of financing was participated by Asia Advisors Korea, Gate Ventures, ICC, Planetarium, Presto, RFD Capital, etc. This funding will promote Kroma’s mission to make Web3 more accessible through advanced Layer 2 solutions powered by Kroma’s zk proof library Tachyon. Kroma aims to make Web3 more accessible through intuitive and gamified real dApps.

On September 8, Web3 ecosystem service Nest Layer announced the completion of a new round of financing, with Manta Foundation Fund participating. The specific valuation and financing amount have not been disclosed. The new funds will be used to support the development of its product suite Dropnest. Nest Layer currently supports services including investment, node management, NFT, airdrop farming, staking, income generation and DePIN. Dropnest can simplify airdrop farming through a one-click interface.

According to BlockBeats, on September 8, Arris, a comprehensive airdrop task platform, announced the completion of a new round of strategic financing, with participation from K24 Ventures, CGV FoF, DMAIL.AI, and Alco Holdings. The specific financing amount and valuation information have not yet been disclosed. The new funds will be used to support its airdrop protocol optimization and simplification of Web3 chain interactions. In addition, Arris will also expand its Arris AI and optimize airdrop interaction returns through the OiEarn model to provide points rewards to users who increase transaction volume.

Digital asset management/payment

There were 2 financings in the field of digital asset management/payment, with a total amount of over 8 million US dollars, accounting for 6.15% of the total financing last week. Including:

IDA

On September 2, Hong Kong stablecoin issuer IDA completed a US$6 million seed round of financing. This round of financing was led by CMCC Global, with participation from Titan Fund, Hashed, Hack VC, Anagram, GSR, Protagonist, Brinc, Chorus One, Kenetic, SNZ and others.

HKDA is a fiat-referenced stablecoin that aims to enhance seamless commercial and payment connections between Hong Kong and global markets. The stablecoin is designed to cross borders and time zones to provide smoother connections for global commerce and payments. In summary, as a stablecoin, HKDA strives to provide seamless payment and business solutions for Hong Kong and global markets, with the goal of reducing currency volatility through its fiat-referenced characteristics while improving the convenience and speed of cross-border transactions.

The capital injection will enable IDA to advance the development and launch of its first fiat-referenced stablecoin, HKDA, which is designed to be regulated in Hong Kong. Initially starting in Hong Kong, IDA will leverage cutting-edge fintech and Web3 technologies to cover other countries whose currencies are pegged to the US dollar.

Puntored

On September 8, Puntored, a fintech company for cross-border transactions on the chain, announced that it had completed a $2 million financing round, with the Stellar Development Foundation participating in the investment through its Stellar Enterprise Fund.

Puntored is a blockchain-driven fintech company focused on providing cross-border payment services. It enables cross-border transactions in Latin America through the Stellar blockchain network. It mainly explores digital wallets, enterprise embedded payment services and SME credit, providing financial transaction services to users in rural, metropolitan and remote areas in Mexico, Colombia and Puerto Rico.

Web3+AI

In the Web3+AI field, there was a total of 1 financing, with a total amount of approximately US$5 million, accounting for 4.07% of the total financing last week. Including:

TrendX

On September 2, according to official news, TrendX, an AI-driven one-stop platform for Web3 trend tracking and smart trading, announced the completion of a US$5 million Series A financing round, led by Promontory, Coinstash, Frontier Research, Coresky, Tido Capital and Bullperks.

TrendX mainly provides a stock market prediction system based on artificial intelligence (AI). It helps investors quickly and accurately capture stock market trends by using big data, machine learning and complex algorithms, so as to develop more profitable investment strategies. TrendX’s system captures tiny price changes by performing a large number of calculations on each stock (such as 100,000 analyses per stock), helping investors make informed decisions before market trends are released. It is reported that the new funds will be used to advance TrendX’s technology development, expand market share and recruit.

Other financing

There was one other financing, with a total amount of US$6 million, accounting for 4.89% of the total financing last week. Including:

PuffPaw

On September 5, CoinDesk reported that PuffPaw, an e-cigarette on-chain platform, completed a $6 million seed round of financing, led by Lemniscap Ventures. PuffPaw will be based on the Berachain network.

It is reported that the Puffpaw project plans to launch a blockchain-enabled e-cigarette that aims to help users reduce nicotine intake through token incentives. The project encourages users to quit smoking by recording their smoking habits and rewarding them with tokens. Puffpaw’s token economics aims to cover 30% of the user’s first month of using its products and provide social rewards. The project also considers possible system abuse, but is unclear about the problem that users may not report their smoking habits honestly.