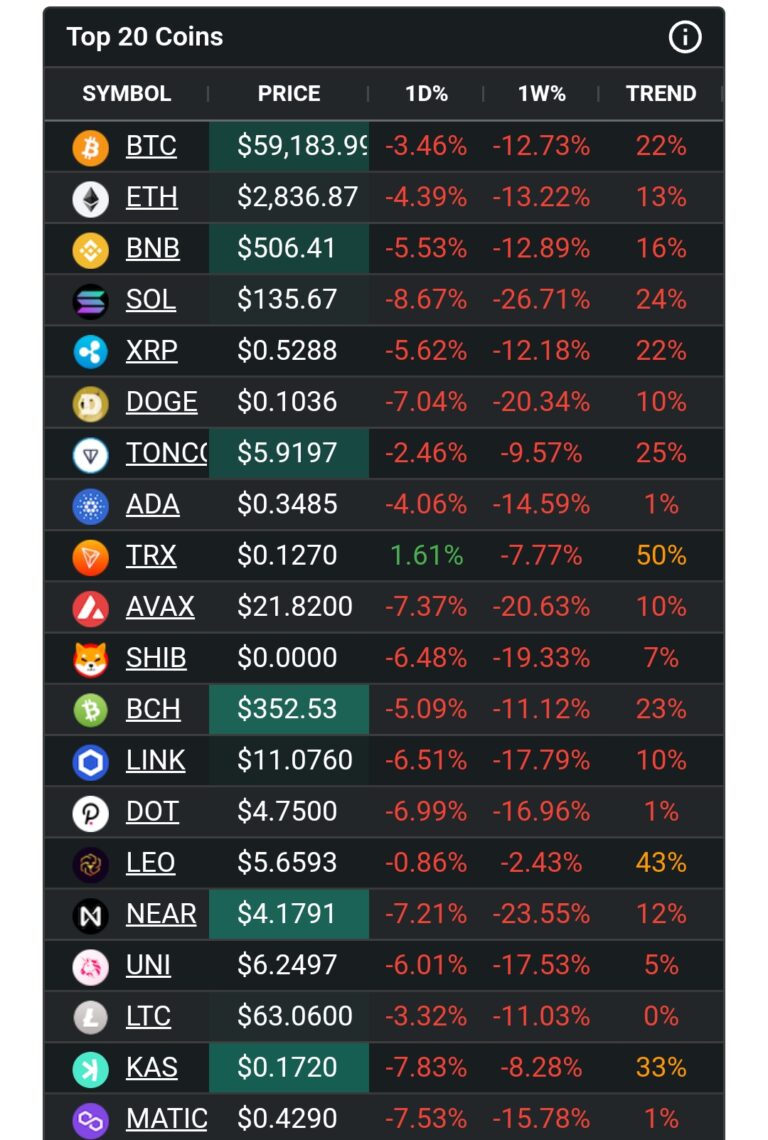

- Market downtrend observed across top 20 cryptocurrencies.

- Tron (TRX) shows short-term bullish potential.

- Significant declines in Solana (SOL) and Binance Coin (BNB).

- Bitcoin (BTC) and Ethereum (ETH) lead the market in a downward trend.

Market Downtrend: Widespread Declines

The crypto market has experienced a noticeable downtrend over the past week, with the majority of the top 20 cryptocurrencies showing significant declines. This bearish trend reflects the market’s current sentiment, influenced by a mix of external factors and investor behaviors.

Top Performers: TRX Shows Resilience

- TRX (Tron):

- Price: $0.1270

- 1D Change: +1.61%

- 1W Change: -7.77%

- Trend: 50%

Despite the overall market downturn, Tron (TRX) has shown a positive daily change of +1.61%. This resilience suggests potential short-term bullish sentiment, even though it has suffered a weekly loss of -7.77%. TRX’s ability to perform positively on a daily basis indicates that some investors still see value, providing a glimmer of hope amidst a generally bearish market.

Notable Declines: SOL and BNB Under Pressure

- SOL (Solana):

- Price: $135.67

- 1D Change: -8.67%

- 1W Change: -26.71%

- Trend: 24%

Solana (SOL) has experienced a significant drop, with its price plummeting by -8.67% in the past day and -26.71% over the week. This steep decline highlights the strong bearish momentum affecting SOL, reflecting broader market concerns and selling pressure.

- BNB (Binance Coin):

- Price: $506.41

- 1D Change: -5.53%

- 1W Change: -12.89%

- Trend: 16%

Binance Coin (BNB) is also facing consistent declines, with a daily drop of -5.53% and a weekly loss of -12.89%. This sustained downward trajectory points to significant selling pressure, impacting BNB’s market position and investor confidence.

Market Leaders: BTC and ETH Influence Overall Sentiment

- BTC (Bitcoin):

- Price: $59,183.99

- 1D Change: -3.46%

- 1W Change: -12.73%

- Trend: 22%

As the market leader, Bitcoin (BTC) has a profound impact on the overall market sentiment. BTC’s current price of $59,183.99 reflects a -3.46% daily decline and a -12.73% weekly drop. The downtrend in BTC significantly influences the broader crypto market, steering it towards a bearish outlook.

- ETH (Ethereum):

- Price: $2,836.87

- 1D Change: -4.39%

- 1W Change: -13.22%

- Trend: 13%

Ethereum (ETH), another major player in the crypto space, is also on a downward path. With a price of $2,836.87, ETH has seen a -4.39% daily change and a -13.22% weekly decline. Similar to BTC, ETH’s performance contributes to the overall bearish sentiment in the market.

Mixed Performers: LEO Displays Stability

- LEO (LEO Token):

- Price: $5.6593

- 1D Change: -0.86%

- 1W Change: -2.43%

- Trend: 43%

LEO Token (LEO) stands out for its relative stability amidst the market turmoil. With a minimal daily decline of -0.86% and a weekly drop of -2.43%, LEO demonstrates less volatility compared to other cryptocurrencies. This stability may attract risk-averse investors looking for safer options during uncertain times.

Most Volatile: NEAR Sees Large Swings

- NEAR (Near Protocol):

- Price: $4.1791

- 1D Change: -7.21%

- 1W Change: -23.55%

- Trend: 12%

Near Protocol (NEAR) has been highly volatile, with a significant daily drop of -7.21% and a substantial weekly decline of -23.55%. This high volatility indicates potential risk, with large price swings making it both an opportunity and a challenge for traders.

Bullish or Bearish: Bearish Overall Sentiment

The overall market sentiment remains bearish, driven by the widespread declines in the majority of top cryptocurrencies. The significant losses observed over the past week suggest cautious investor behavior, with many opting to sell rather than hold, contributing to the downward trend. As the market navigates these challenging times, investors should stay informed and consider both the risks and opportunities presented by the current market dynamics.