Original author: Black Mario

Are there still Alpha opportunities in the DeFi market?

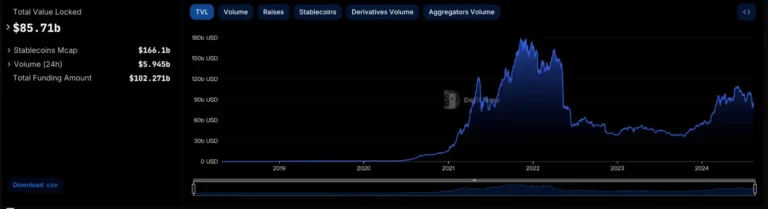

DeFi is on the decline

Decentralized finance (DeFi) was once the starting point for the development of the blockchain world and an important pillar of liquidity in the on-chain world. However, since the total locked value (TVL) in the DeFi field reached a historical peak of more than 180 billion US dollars in 2021, the DeFi track has begun to decline due to a series of black swan events. Although factors such as the inscription craze and ETFs at the beginning of this year triggered a new round of bull market, as of August 2024, the total TVL of DeFi has fallen back to around 40 billion US dollars, far from its peak.

From the user’s perspective, the initial DeFi market was full of Alpha opportunities. Whether it was liquidity mining, lending, or the emerging on-chain derivatives market, they all provided users with considerable returns. For example, in the DeFi summer of 2020, the annualized yield of liquidity mining was as high as hundreds or even thousands of percentage points, triggering a large influx of funds. However, since 2023, with the rise of a series of narratives such as DePIN, RWA, and AI, the story of DeFi has gradually faded from people’s horizons and become a forgotten part of the rotation of sectors in the crypto world. As the overall narrative of DeFi gradually weakens and the direction remains unchanged, the industry is seriously involuted, and the sharp decline in user returns has further exacerbated the loss of funds. At present, the annualized yield of lending protocols has dropped to 5%-10%, a significant drop compared to the early days.

DeFi is becoming a red ocean market, and many DeFi protocols are struggling to develop. For example, Fuji Finance and Gro Protocol, which were once highly regarded, have stopped services due to difficulties in maintaining operations. At the same time, different blue-chip DeFi projects are facing different challenges. The daily trading volume of protocols such as Uniswap and Curve has dropped by more than 50% from their peak, while Aave and Compound are struggling to deal with debt crises and profit distribution issues. MakerDAO is trying to innovate its lending system and capture market growth by introducing RWA assets and launching a new NST stablecoin.

In any case, when investors look back, they will find that most DeFi ecosystems are difficult to attract new funds and users due to old narratives and lack of innovation in products. At this stage, market participants’ attention is usually focused on more mature markets, which also makes it difficult for investors to find new Alpha opportunities.

“Looking forward”

But if we look forward, if a DeFi ecosystem has more novel narrative capabilities, more innovative product systems, continuous growth, and is severely underestimated in the early stages, then it will definitely be a new treasure trove of Alpha opportunities. Looking in this direction, we believe that Pencils Protocol, the leading project of the Scroll ecosystem, is one of the few examples that meets the above conditions.

Pencils Protocol itself is an ecosystem with comprehensive functions, providing financial services such as auctions and revenue aggregation. In addition to being able to capture native on-chain revenue based on Farming, Vault (advanced strategy library), etc., the protocol also supports users to capture additional pre-market rewards including series points, and in addition to being able to be combined with various LSD protocols, it can also serve as a liquidity underlying facility. In addition, including its novel sections such as Shop and Auction, it also supports users to further explore revenue through NFTFi, RWA, etc., and retains a multi-functional interface for combination with more narratives.

While the vast majority of DeFi protocols are still building DeFi systems with DEX, lending, and perpetual derivatives as the core to continue to dominate the red ocean market, Pencils Protocol is no longer confined to the framework of classic DeFi protocols. It has made significant breakthroughs in products and narratives, and hopes to burst into the blue ocean market.

Pencils Protocol has had many highlights since it was launched on the market. A few months ago, it received a financing of US$2.5 million from a number of top capitals including OKX Ventures, Animoca Brands, Galxe, Gate.io Labs, Aquarius, Presto and Agarwood Capital, as well as individuals including Scroll co-founder Sandy Peng, V Fund partner Ashely Xiong, Inception Capital co-founder David Gan, Cyberconnect founder Ryan Li, and Arcanum Capital co-founder Lucia Zhang, with a valuation of US$25 million.

Meanwhile, in September, Pencils Protocol received a new round of strategic financing from well-known investment institutions such as DePIN X, Taisu Ventures, Black GM Capital and Bing Ventures at a valuation of US$80 million.

At the same time, Pencils Protocol has also joined a series of official Scroll ecosystem programs including Scroll Sessions. The project has always maintained a high level of attention in the crypto market.

Pencils Protocol’s TVL has also been soaring with the progress of the series of markets, especially from July 22 to 23, when its TVL soared from $200 million to $300 million in just 24 hours, breaking the historical record of DeFi protocols achieving capital growth on a single chain. Valuation represents the expectation of the development potential and imagination of the ecosystem itself, and the market’s valuation of Pencils Protocol, which has emerged and is in the early stages of development (not yet TGE), is obviously low.

Let’s explore Pencils Protocol in more depth and look for potential Alpha opportunities together.

Pencils Protocol Product Section

As mentioned above, Pencils Protocol itself is not a DeFi platform focusing on a single function, but a multifunctional integrated service platform that includes many basic functions and novel functions, and can bring a series of benefits to investors in various ways. Pencils Protocol’s product sections include Farming, Vault, Auction, and a series of expansion function sections.

Farming

Farming is a pre-market incentive income market with leverage characteristics. This sector mainly uses staking to pledge assets and can provide users with multiple incentives of different points. Users will be able to obtain different points by staking different assets. Currently, the assets that support staking in the Farming sector mainly include several categories, ETH LRT tokens, BTC LRT tokens and stablecoins.

Some potential pre-market points that can be mined include: Pencils Points of the Pencils Protocol; Socrll Marks of the Scroll chain; Eigenlayer Points; and some LRT project points such as Stone Points, Kelp Miles, Puffer Points, Etherfi Loyalty Points, Solv XP, Mind XP, etc. Staking different tokens can get different points in different multiples, ranging from about 1 to 8 times. Users can further achieve the “one fish, two ways” effect with extremely high efficiency.

Therefore, from the perspective of Pencils Protocol itself, it further endows LRT assets with incentives in the direction of staking in a composable way, encouraging more users to participate in the staking of the LRT protocol. From the perspective of Pencils Protocol, by providing incentive support for staking of various LRT assets, it quickly absorbs potential holders of these projects and assets.

On the other hand, from the perspective of pre-market incentives, this field is currently in the early stages of growth, and a series of pre-market incentive trading markets have emerged, including Whales Market and Pendle. Pre-market incentive outputs with leverage effects, such as Pencils Protocol, are very popular and attract much attention. Currently, Staking is the main sector open to Pencils Protocol, and with the promotion of this sector alone, its single-chain TVL can achieve explosive growth and quickly exceed 300 million US dollars. It is not only the project with the highest TVL in the Scroll ecosystem, but also sits firmly in the top position in the LRT track and pre-market incentive market. At present, Pencils Protocol can still provide various pre-market incentive rewards in a leveraged manner for a long time, and users will be able to continue to capture many Alpha opportunities in this direction.

Vault

The Vault section is a native income market with a liquidity mining model as its core, but it also further adds leverage factors to the original LP model, that is, users can obtain LP income exponentially through lending + leverage.

On one hand, the Vault section is connected to the Staking pool, supporting users to lend assets to the Staking pool. On the other hand, the Vault 1.0 version will be connected to the liquidity pools of various DEXs in the Scroll ecosystem, supporting users to become LPs through liquidity mining and capture liquidity mining income.

In this model, users can earn higher returns through leverage with less capital, and only need to pay part of the income to Pencils Protocol as interest. At the same time, early active participants of Vaults can not only obtain basic rewards for deposit staking and LP staking, but also receive high multiples of points and token rewards, which will greatly increase the enthusiasm of users to participate in the Vault section.

Users can borrow funds through the vault to increase their returns. Take the user who mines ETH-USDC LP as an example:

Users hold a small amount of USDC and can choose to borrow more USDC.

Vault splits assets into 50% ETH and 50% USDC.

These assets are deposited into the DEX liquidity pool and rewards are obtained after staking LP tokens.

The interest on the user’s borrowed funds will be automatically deposited into the Staking deposit pool to pay depositor rewards. The Vaults pool releases funds by evaluating the principal and leverage multiples. This process can effectively ensure the safety of depositors’ funds, and unlike the classic lending protocol model, there is no liquidation risk for the funds themselves.

By connecting to the capital pools of various DEXs, Vault can continuously provide liquidity services to these DEXs, greatly improving the quality of these DEXs in capturing liquidity and lowering the threshold. On the staking side, the funds deposited in the pledge pool will be further mobilized, greatly improving the utilization rate of these funds, especially for various LRT assets, which can well capture liquidity in the Scroll ecosystem and better establish a value circulation system for these LRT ecosystems.

In fact, in the first two rounds of market cycles, representative yield aggregation platforms such as Yearn Finance and Alpaca Finance have emerged. The former’s early market valuation was between 3 billion and 5 billion US dollars, and the latter’s market value was about 1 billion US dollars at its peak. Before the emergence of Pencils Protocol’s Vault product, there was no groundbreaking aggregation yield platform. The Vault product is deeply bound to the LRT market, pre-market incentive market, etc., and provides users with a series of yield grippers through leveraged mining.

In the long run, Vault will focus on user asset management, such as integrating more high-quality assets, and launching a variety of asset income methods such as on-chain Delta neutral strategies, on-chain synthetic income, and on-chain exotic options to further expand income channels. Judging from the valuations of Yearn Finance and Alpaca Finance, the valuation of Vault’s product segment alone is very promising.

It is also worth noting that the Vault sector, backed by hundreds of millions of dollars in TVL, will have a huge business volume, and it plans to continue to use 20% of its revenue to repurchase and destroy $DAPP tokens, which will provide a basis for the continued increase in the value of the tokens.

Overall, from the perspective of the Vault section, many of its designs are very novel and form differentiated competition with other DeFi protocols. Competition in different dimensions can not only bring rapid growth potential to Pencils Protocol and bring sustained and substantial income to the platform, but it is also expected to become an important entry point for users to explore Alpha opportunities.

Auction

Auction is one of the core functions of the Pencils Protocol section, including the LaunchPad function and the auction function of NFT and RWA assets.

In fact, Pencils Protocol was originally positioned as LaunchPad. By inheriting the series of advantages of Scroll’s underlying layer, it aims to build a high-quality asset launchpad for the Scroll ecosystem. Users can use the LaunchPad platform to first discover high-quality assets and good projects in the Scroll ecosystem, and project owners can also use the huge user base of the Pencils Protocol ecosystem to more widely capture users, funds, and attention, and further realize the early launch of the ecosystem. From the perspective of the Scroll ecosystem itself, most of the high-quality projects in the ecosystem do not have TGE (including the Scroll project itself), such as Kelp DAO, which has a close cooperation with Pencils Protocol. Therefore, as the largest and earliest LaunchPad platform in the Scroll ecosystem, Pencils Protocol is expected to become an important value entry in this direction.

In addition to the conventional LaunchPad function, Pencils Protocol has further introduced auction functions for some RWA assets and NFT assets. Based on this function, a series of scenarios can be derived. For example, after some real-world assets are RWA-ized or NFT-ized, they can be expanded to a wider user group through the auction function to improve the efficiency of value transfer. At the same time, the entire process can ensure fairness based on the open and transparent execution of the contract. Similarly, some assets with certain value but lack of certain liquidity can also be further given liquidity through auctions.

The auction function can be expanded to many scenarios and combined, while retaining an interface for the ecosystem to expand in a broader narrative direction (Web2+Web3).

Expanded functionality

Pencils Protocol has also built some extensible functions to promote the better rotation of the ecological value flywheel. Currently, there are two main directions, one is the points system and the other is the Shop function.

1. Pencils Points System

The points system itself is centered around Pencils Points. The system will record user behavior, such as users’ contributions to the development of the ecosystem within the platform (joining the community for construction and helping with ecosystem promotion and marketing, etc.), use of the platform’s series of functions, etc., and issue Pencils Points to users as an incentive to encourage users to join in the construction of the ecosystem.

From the perspective of Pencils Points itself, it is not only a pre-market incentive asset, that is, it is used to redeem the ecological token $DAPP after TGE. Holding the points can also obtain a series of ecological rights, including:

Get more token allocations and receive discounts on future projects launched on Pencils Protocol.

Purchase a variety of items, NFTs, and virtual or physical goods through the Pencils Protocol Shop.

Get higher leverage in the Pencils Protocol Vault

Priority access to Pencils Protocol airdrops

Therefore, from the point of view of the points system itself, points will promote and motivate more users to join the ecosystem, drive users to contribute to the ecosystem, use the platform’s products, and further expand the user base. The development of the platform will continue to empower points in multiple dimensions of value, and greatly improve the effectiveness of incentives, thereby increasing user stickiness and achieving a positive value cycle.

2.Shop

The Shop section is also an innovation of Pencils Protocol. The Shop section will launch some non-standard high-quality assets for ecological users to purchase. The asset types of the Shop section are relatively broad, including some NFT assets (game props, equity cards, artworks, collectibles, etc.), RWA assets (traditional financial products, auction assets, etc.) and even some physical assets. The Shop function can expand the Pencils Protocol ecosystem in more directions, including potential areas such as games, social networking, traditional finance, etc., and become a new comprehensive Web3 trade window. When users use Pencils Points to redeem or use \(DAPP tokens to pay, they can get some discounts, which will further broaden the application scenarios of Pencils Points, \)DAPP tokens, etc., and at the same time bring further considerable income opportunities to the ecosystem.

The narrative potential of Pencils Protocol

Ecological moat

In fact, the Pencils Protocol ecosystem has built a wider ecological moat for its future long-term development. We believe that the elements of this moat system include novel narrative capabilities, bilateral network effects, and the platform’s revenue capabilities.

Novel narrative

As we mentioned above, each product section of Pencils Protocol itself has a differentiated and innovative design. For example, the conventional DeFi framework has been broken in the Farming and Vault sections. On the one hand, some high-quality points can be mined through leverage through Farming, and on the other hand, leveraged mining can be achieved through a risk-free lending model. No matter which direction, users can achieve “twice the result with half the effort” and allow the B-side to obtain good liquidity effects.

As for the Auction, Shop and other series of sections, interfaces are further reserved for the combination of DeFi with many potential fields such as SocialFi, GameFi, RWA, etc., and the narrative direction of DeFi is continuously broadened through new composability. It can also continuously attract users and funds from the external market, rather than just focusing on the classic DeFi red ocean market.

Two-sided network effect (double value flywheel)

The overall bilateral network effect of Pencils Protocol is reflected in two aspects: one is the mutual promotion and growth of the Farming section and the Vault pool, and the other is the mutual promotion between Pencils Protocol and the external liquidity market.

From the first perspective, the Farming sector is essentially more like a lending pool for different assets, which continuously promotes the depth of the pool through extremely attractive incentives. For example, it currently supports users to mine pre-market incentive points through leverage, attracting users to continuously pledge LRT assets to the pool and realize the mining of pre-market incentive points through leverage.

From the perspective of the Vault pool, the better the asset thickness and depth of the single-asset Farming pool, the better the Vault-side user experience in lending the asset (liquidity, cost), and the higher the user’s potential leveraged mining income, which in turn provides a higher income distribution for the asset in the Farming pool. Therefore, the “Farming side” and the “Vault side” have a bilateral network relationship with each other, forming an internal value circulation flywheel.

From the second perspective, the bilateral network relationship between Pencils Protocol and the external liquidity market.

From the perspective of the token liquidity market, the “Farming end” and “Vault end” of Pencils Protocol are the entrance and exit of liquidity, respectively. Users pledge their assets through the “Farming end” and use the “Vault end” to leverage mining in the external liquidity market (DEX, etc.).

For project owners, they expect users to provide liquidity for their tokens through the Vault pool (especially leveraged mining can bring double liquidity effect) in order to build a healthier token market.

The measures that the project party may take include providing better incentives for the “Farming side” and “Vault side” of Pencils Protocol, calling on more community users to join the staking of the “Farming side”, etc. The increase in the staking scale of the “Farming side” is expected to further promote the income of “Vault side” users, and then mobilize users to conduct “Vault side” leveraged mining based on the project tokens, so as to bring better liquidity effects to the project tokens. This process will also continue to push up the TVL of Pencils Protocol.

Therefore, the DeFi sector of Pencils Protocol and the external liquidity market will continue to generate bilateral network relationships to form an external value flywheel.

The internal value flywheel and the external value flywheel will continue to promote and empower each other. As an important liquidity engine of the Scroll ecosystem, Pencils Protocol will continuously gain incremental value.

So we see that just in the early stage (only the Farming section is open), the TVL of Pencils Protocol can reach 300 million US dollars, and with the operation of the open double flywheel of the Vault product, the TVL data is still expected to continue to soar.

Profitability of the platform

Each section of Pencils Protocol has a certain profitability. In the initial stage, it will focus on the DeFi product section, including Farming and Vault sections.

In the Farming section, the platform will charge a small fee when users stake and withdraw rewards. Judging from the current TVL of US$300 million (dynamic staking and withdrawal), it can already generate considerable income for Pencils Protocol.

In the upcoming Vault section, whenever a user earns income from leveraged mining and future strategy libraries, the platform will collect a portion of it as the platform’s income. It is worth noting that the income captured by users through the Vault section comes from the platform’s external ecology rather than a zero-sum game, such as providing liquidity for different liquidity markets on Scroll (multi-chain in the future) to obtain mining income, so whenever the Vault section brings profits to users, the Pencils Protocol ecosystem will gain value increments and income.

In particular, with the accelerated operation of the above-mentioned dual value flywheel system, the profitability of the Pencils Protocol DeFi sector will continue to increase.

In addition to the DeFi sector, Pencils Protocol’s Auction and Shop sectors also have certain expectations for continued profitability.

From the perspective of the Auction section, Pencils Protocol itself is the asset launcher of the Scroll ecosystem, providing launch services for high-quality projects in the ecosystem, and is also one of the main businesses of Pencils Protocol. At present, the Scroll ecosystem is still in its early stages of development, and there are many high-quality projects that have not yet TGE, and the Scroll ecosystem is still in a period of rapid growth dividends. As an important value hub of the Scroll ecosystem, Pencils Protocol will have a wide range of direct income opportunities by providing launch services for many high-quality projects and providing users with channels to participate in new launches of high-quality projects.

In addition, as a platform that gathers investors’ attention, by continuously empowering auctions, shops and other sections, these attention values will also be able to help Pencils Protocol explore more additional business models and continue to capture revenue from many broad potential markets including RWA.

Compared with most DeFi ecosystems, the revenue structure of Pencils Protocol is hierarchical, diversified and extensive. These considerable revenues will continue to provide impetus for the development of the ecosystem.

So overall, novel narratives, bilateral network effects, and considerable profitability are helping Pencils Protocol build a relatively broad value moat, which is the most important foundation for the potential of ecological narratives.

Token Expectations

Pencils Protocol still has no TGE, which means it is still in the very early market stage, and users are currently more focused on the incentives of Pencils Points. Of course, we might as well make an early expectation of the $DAPP token.

Application scenarios

The $DAPP token itself has many functions. In addition to governance direction, it can directly and deeply relate to the rights and interests of users.

Pencils Protocol has set up a native staking plan for the \(DAPP token (launched after TGE), that is, token holders can stake \(DAPP) in Pencils Protocol Farms and obtain the proof-of-stake token \(pDAPP) at a 1:1 ratio. \(pDAPP holders can obtain subsidies by staking \(pDAPP) or provide \(pDAPP) liquidity on DEX.

In the Vault section, users who want to get more points incentives, higher leverage multiples, priority use of exclusive features, and richer strategy products need to stake DAPP tokens. On the auction platform, sellers who want to list assets on the platform must stake DAPP tokens to prevent malicious activities.

In terms of utility, Pencils Protocol is also planning to integrate \(DAPP tokens into various DeFi products, including liquidity protocols and lending services, allowing users to optimize asset allocation by providing liquidity, lending or participating in staking, and obtain additional reward utility from these activities. At the same time, holding \)DAPP tokens will further accelerate the equity attributes of Pencils Points holders, obtain better income distribution based on different Farming methods, and thus promote deeper community participation and loyalty.

In the Shop section, users can use $DAPP to conduct margin trading of NFTs, RWA assets, points, and derivatives, thereby expanding the utility and application of their assets in the Pencils Protocol ecosystem.

Therefore, from the perspective of application scenarios, the DAPP token itself has extremely broad rigid demand. Users can convert it into income and rights by staking, holding, and using the DAPP token. The broader the business scope of Pencils Protocol, the stronger the rigid demand for the $DAPP token.

Destruction

Pencils Protocol plans to continuously destroy \(DAPP tokens) through platform revenue. Currently, 20% of the Vault section’s revenue is clearly stated to be used to destroy \)DAPP tokens. In addition to this section, other sections have also set up destruction mechanisms. Based on their profitability, it will still play a good role in promoting the deflation of $DAPP tokens.

Therefore, from the perspective of the application system and destruction plan, the continued rigid demand and deflation will be able to continuously boost the value of the $DAPP token, and it has good market expectations in the long term.

Valuation

Pencils Protocol itself is a comprehensive platform, which covers many features such as liquidity mining, staking, lending, aggregated income, auctions, etc. The product itself spans many tracks and can be expanded to GameFi, SocialFi, RWA and many other tracks based on a series of functional modules. Based on its narrative, product functions and overall development potential, as well as its broad ecological development moat, explosive funds, and user growth, it is expected to become a blue chip in this round of bull market from the direction of comprehensive DeFi service ecology.

In order to better reflect the valuation of Pencils Protocol, we selected representative Alpha blue-chip projects in different tracks in the last two bull markets for comparison.

Yearn Finance

Yearn Finance is the first generation of yield aggregator. Based on the total assets under management (TVL), the number of strategies developed, community participation, and integration with other DeFi projects, Yearn Finance’s TVL once exceeded $4 billion, and the valuation of its entire ecosystem was once estimated by the market to be between $3 billion and $5 billion. From the perspective of tokens, YFI’s market value was close to $2.5 billion at its peak.

Uniswap

Uniswap is the largest DEX in the past two bull markets. Its daily trading volume exceeded billions of dollars during the bull market. Based on the trading volume and liquidity pool size of its platform, as well as its fundamental role in the DeFi ecosystem, its ecosystem was once valued at $20-30 billion by the market. The market value of its token UNI reached a maximum of $22.5 billion.

Sushiswap

Although SushiSwap was originally a fork of Uniswap, it has carved out a niche in the DeFi space through rapid innovation and community-driven development. In addition to traditional AMM (automated market maker) functions, SushiSwap has expanded its products to include Kashi (lending market), BentoBox (universal liquidity pool), and Miso (decentralized issuance platform). Considering the scale of the ecosystem, innovation capabilities, and other comprehensive aspects, SushiSwap’s valuation during the bull market was considered to be between $5 billion and $10 billion, and at the peak of the bull market, the market value of the $SUSHI token was close to $3 billion.

Ghost

Aave is the leader in the DeFi lending space. Based on the scale of lending on the platform, the use of innovative products such as “flash loans”, the ability to scale across chains, and its widespread adoption in the entire DeFi ecosystem, its valuation is around $15-20 billion. At the peak of the bull market, its token $AAVE had a market value of over $6 billion.

Lido Finance

Lido is one of the largest liquidity staking service providers. Based on the size of the Ethereum market it stakes (at the peak of the bull market, Lido controlled more than 30% of the Ethereum staking market share) and the platform’s growth potential, Lido’s ecosystem valuation once reached US$10-15 billion. At the peak of the bull market, the market value of its tokens was close to US$10 billion.

The above-mentioned blue-chip DeFi market is more focused on a single field and has been the leader in the corresponding track for many years. It is not ruled out that the impact of the Fed’s unlimited QE on the crypto industry has caused some head projects to be overvalued. Considering the fundamentals and business aspects of Pencils Protocol, its ecosystem has a potential valuation of more than 10 billion US dollars. Compared with the valuation of the tokens of the above-mentioned projects at their peak, the conservative valuation of the market value of the DAPP token is also expected to be more than 5 billion US dollars. So at present, the valuation of the Pencils Protocol ecosystem is seriously underestimated, and the market performance of the DAPP token after TGE is still worth looking forward to.

Summarize

Judging from the overall development history of the DeFi track, after its emergence, DeFi also experienced narrative fermentation in the first year of 2020, the rapid bubble of asset prices in 2021, and the disillusionment stage after the bear market bubble burst in 2022. At present, with the full verification of the fit between products and the market, it is emerging from the trough of narrative disillusionment and building its intrinsic value with actual business data.

DeFi itself is one of the few tracks in the crypto field with a mature business model and a growing market space. It still continues to have long-term attention and investment value, but the narrative direction of this track needs to be further innovated.

Pencils Protocol is setting a good example. As a representative of the new DeFi system narrative, it has gradually shown its edge in the Scroll ecosystem, backed by a layered and differentiated product system, a broad narrative direction, and long-term expected profitability. With the full launch of the ecosystem and multi-chain expansion, Pencils Protocol is also expected to become a new unicorn in this field.

From the perspective of investors, by creating a comprehensive and innovative income system ecosystem, it is also becoming the best entry point in the post-DeFi era to lead investors to “look forward” and continue to capture Alpha opportunities.

This article is from a contribution and does not represent the views of BlockBeats